Question: Question 7 (8 points) Using the information from the Operating Expense Budget (Question 4), prepare the Budgeted Cash Payment for Operating Expenses schedule. Remember to

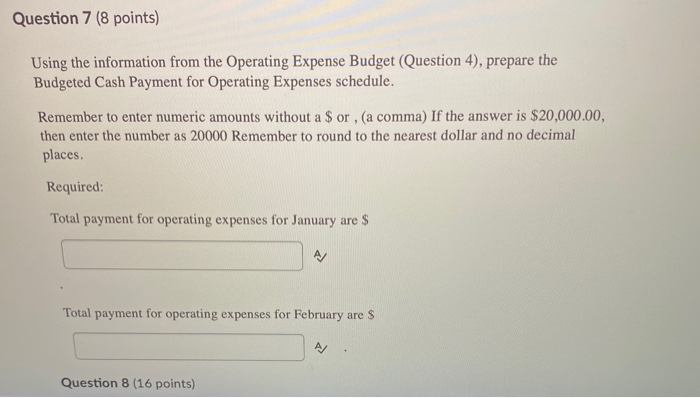

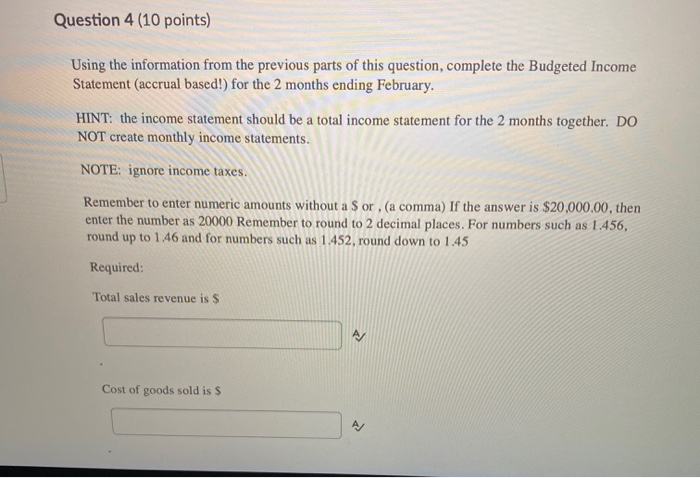

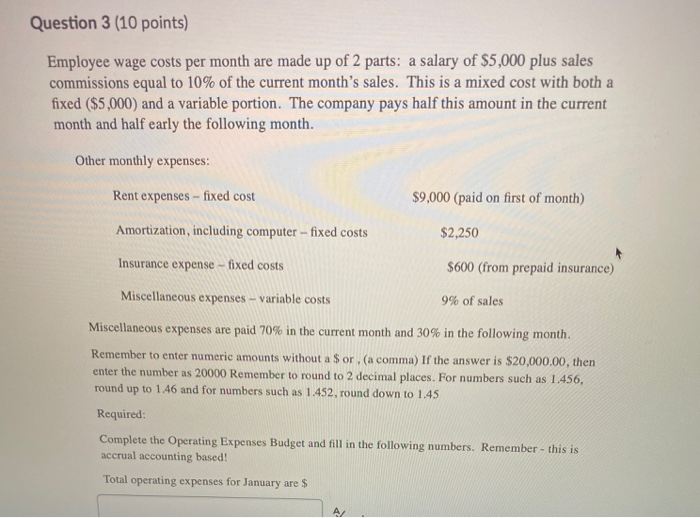

Question 7 (8 points) Using the information from the Operating Expense Budget (Question 4), prepare the Budgeted Cash Payment for Operating Expenses schedule. Remember to enter numeric amounts without a $ or , (a comma) If the answer is $20,000.00, then enter the number as 20000 Remember to round to the nearest dollar and no decimal places. Required: Total payment for operating expenses for January are $ Total payment for operating expenses for February are $ A/ Question 8 (16 points) Question 4 (10 points) Using the information from the previous parts of this question, complete the Budgeted Income Statement (accrual based!) for the 2 months ending February. HINT: the income statement should be a total income statement for the 2 months together. DO NOT create monthly income statements. NOTE: ignore income taxes. Remember to enter numeric amounts without a Sor , (a comma) If the answer is $20,000.00, then enter the number as 20000 Remember to round to 2 decimal places. For numbers such as 1.456, round up to 1.46 and for numbers such as 1.452, round down to 1.45 Required: Total sales revenue is $ Cost of goods sold is $ Question 3 (10 points) Employee wage costs per month are made up of 2 parts: a salary of $5,000 plus sales commissions equal to 10% of the current month's sales. This is a mixed cost with both a fixed ($5,000) and a variable portion. The company pays half this amount in the current month and half early the following month. Other monthly expenses: Rent expenses - fixed cost $9,000 (paid on first of month) Amortization, including computer - fixed costs $2,250 Insurance expense - fixed costs $600 (from prepaid insurance) Miscellaneous expenses - variable costs 9% of sales Miscellaneous expenses are paid 70% in the current month and 30% in the following month. Remember to enter numeric amounts without a $or, (a comma) If the answer is $20,000.00, then enter the number as 20000 Remember to round to 2 decimal places. For numbers such as 1.456, round up to 1.46 and for numbers such as 1.452, round down to 1.45 Required: Complete the Operating Expenses Budget and fill in the following numbers. Remember - this is accrual accounting based! Total operating expenses for January are $ A Question 7 (8 points) Using the information from the Operating Expense Budget (Question 4), prepare the Budgeted Cash Payment for Operating Expenses schedule. Remember to enter numeric amounts without a $ or , (a comma) If the answer is $20,000.00, then enter the number as 20000 Remember to round to the nearest dollar and no decimal places. Required: Total payment for operating expenses for January are $ Total payment for operating expenses for February are $ A/ Question 8 (16 points) Question 4 (10 points) Using the information from the previous parts of this question, complete the Budgeted Income Statement (accrual based!) for the 2 months ending February. HINT: the income statement should be a total income statement for the 2 months together. DO NOT create monthly income statements. NOTE: ignore income taxes. Remember to enter numeric amounts without a Sor , (a comma) If the answer is $20,000.00, then enter the number as 20000 Remember to round to 2 decimal places. For numbers such as 1.456, round up to 1.46 and for numbers such as 1.452, round down to 1.45 Required: Total sales revenue is $ Cost of goods sold is $ Question 3 (10 points) Employee wage costs per month are made up of 2 parts: a salary of $5,000 plus sales commissions equal to 10% of the current month's sales. This is a mixed cost with both a fixed ($5,000) and a variable portion. The company pays half this amount in the current month and half early the following month. Other monthly expenses: Rent expenses - fixed cost $9,000 (paid on first of month) Amortization, including computer - fixed costs $2,250 Insurance expense - fixed costs $600 (from prepaid insurance) Miscellaneous expenses - variable costs 9% of sales Miscellaneous expenses are paid 70% in the current month and 30% in the following month. Remember to enter numeric amounts without a $or, (a comma) If the answer is $20,000.00, then enter the number as 20000 Remember to round to 2 decimal places. For numbers such as 1.456, round up to 1.46 and for numbers such as 1.452, round down to 1.45 Required: Complete the Operating Expenses Budget and fill in the following numbers. Remember - this is accrual accounting based! Total operating expenses for January are $ A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts