Question: Question 7 (9 points) (9 Points Total; 3 each). A bond has a $1,000 face value (FV = $1,000) and a 14 percent coupon or

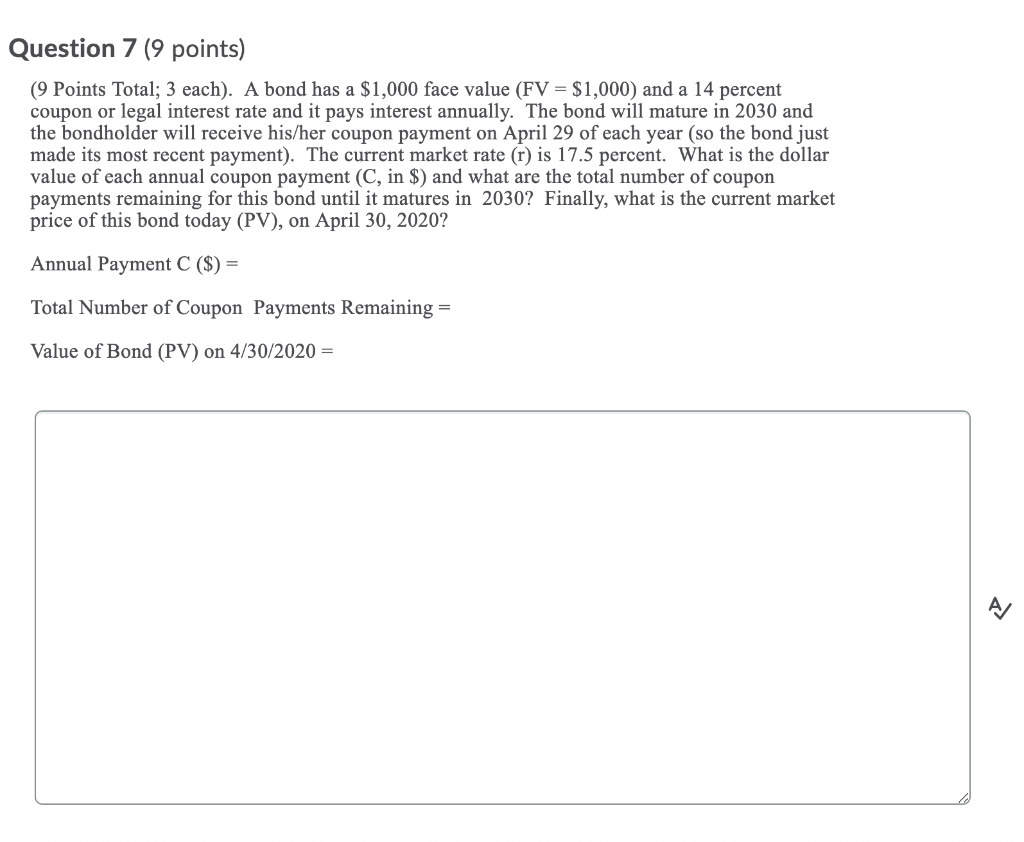

Question 7 (9 points) (9 Points Total; 3 each). A bond has a $1,000 face value (FV = $1,000) and a 14 percent coupon or legal interest rate and it pays interest annually. The bond will mature in 2030 and the bondholder will receive his/her coupon payment on April 29 of each year (so the bond just made its most recent payment). The current market rate (r) is 17.5 percent. What is the dollar value of each annual coupon payment (C, in $) and what are the total number of coupon payments remaining for this bond until it matures in 2030? Finally, what is the current market price of this bond today (PV), on April 30, 2020? Annual Payment C($) = Total Number of Coupon Payments Remaining = Value of Bond (PV) on 4/30/2020 =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts