Question: Question 7. A bank has issued a one-year loan commitment of 11 million for an upfront fee of 50 basis points. The back-end fee on

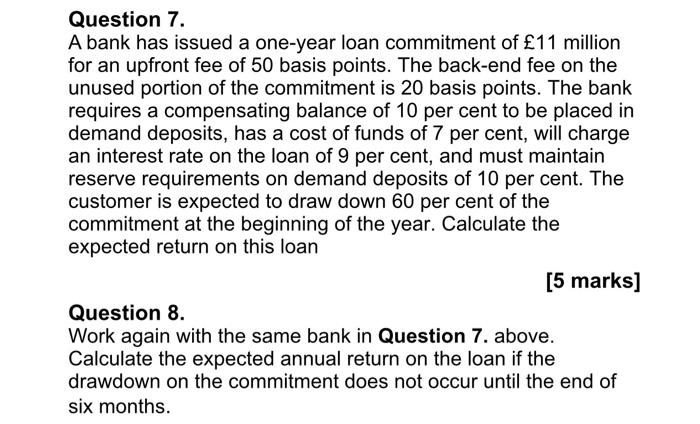

Question 7. A bank has issued a one-year loan commitment of 11 million for an upfront fee of 50 basis points. The back-end fee on the unused portion of the commitment is 20 basis points. The bank requires a compensating balance of 10 per cent to be placed in demand deposits, has a cost of funds of 7 per cent, will charge an interest rate on the loan of 9 per cent, and must maintain reserve requirements on demand deposits of 10 per cent. The customer is expected to draw down 60 per cent of the commitment at the beginning of the year. Calculate the expected return on this loan 5 [5 marks] Question 8. Work again with the same bank in Question 7. above. Calculate the expected annual return on the loan if the drawdown on the commitment does not occur until the end of six months

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts