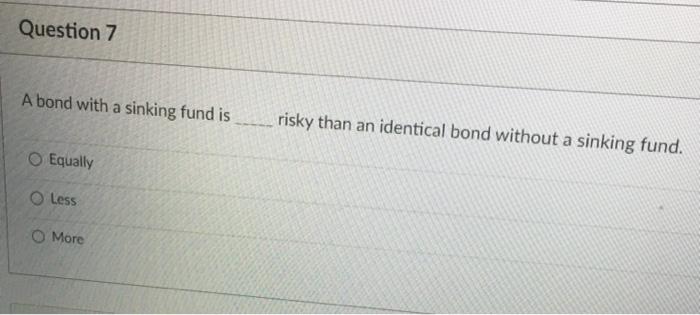

Question: Question 7 A bond with a sinking fund is risky than an identical bond without a sinking fund. Equally Less OMore Question 9 The discount

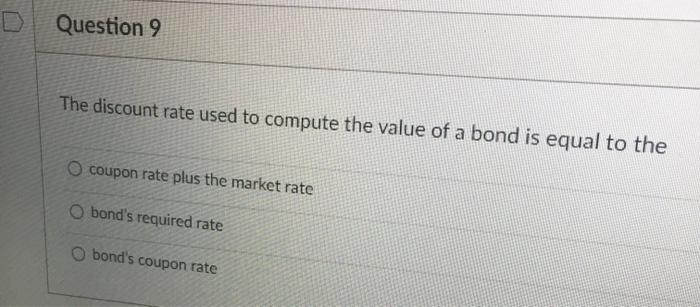

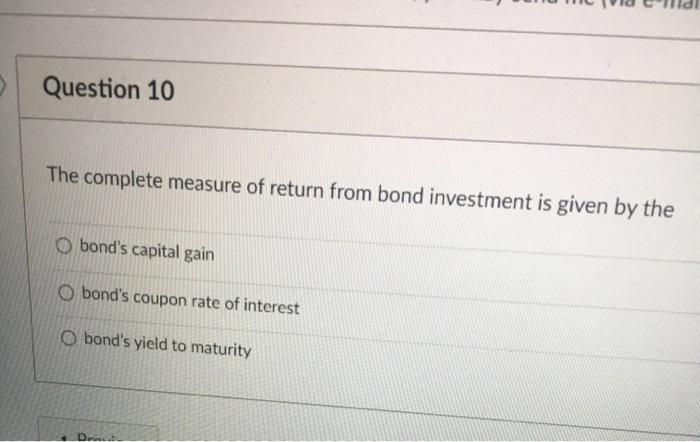

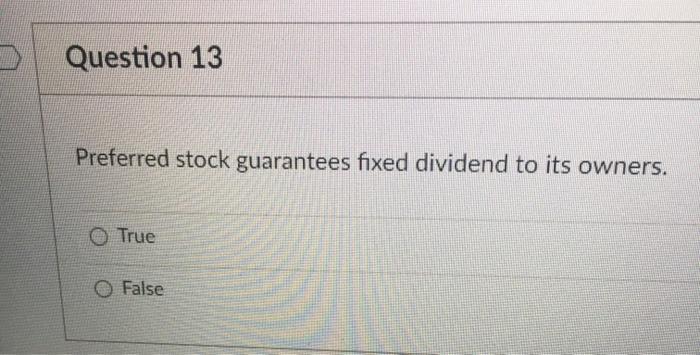

Question 7 A bond with a sinking fund is risky than an identical bond without a sinking fund. Equally Less OMore Question 9 The discount rate used to compute the value of a bond is equal to the coupon rate plus the market rate bond's required rate bond's coupon rate > Question 10 The complete measure of return from bond investment is given by the O bond's capital gain O bond's coupon rate of interest O bond's yield to maturity D. Question 13 Preferred stock guarantees fixed dividend to its owners. True False Question 14 Gordon's model of stock valuation assumes that dividend increases at a constant rate O remains fixed overtime O increases at a variable rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts