Question: QUESTION 7 A borrower is offered a 30 year, fully amortizing ARM with an initial rate of 3.2%. After the first year, the interest rate

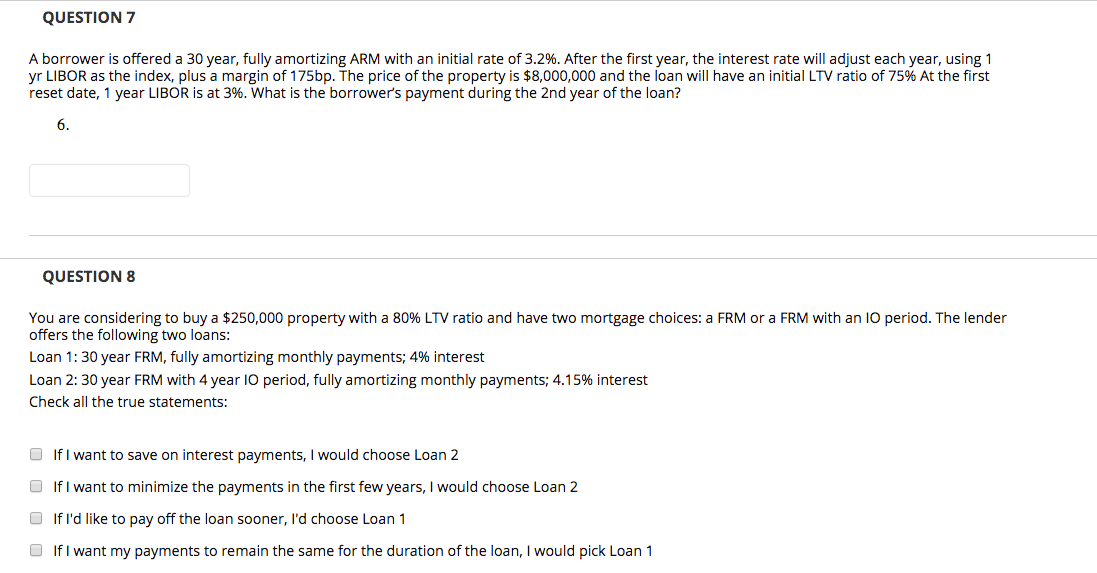

QUESTION 7 A borrower is offered a 30 year, fully amortizing ARM with an initial rate of 3.2%. After the first year, the interest rate will adjust each year, using 1 yr LIBOR as the index, plus a margin of 175bp. The price of the property is $8,000,000 and the loan will have an initial LTV ratio of 75% At the first reset date, 1 year LIBOR is at 3%. What is the borrower's payment during the 2nd year of the loan? QUESTION 8 You are considering to buy a $250,000 property with a 80% LTV ratio and have two mortgage choices: a FRM or a FRM with an 10 period. The lender offers the following two loans: Loan 1: 30 year FRM, fully amortizing monthly payments; 4% interest Loan 2:30 year FRM with 4 year 10 period, fully amortizing monthly payments; 4.15% interest Check all the true statements: If I want to save on interest payments, I would choose Loan 2 If I want to minimize the payments in the first few years, I would choose Loan 2 If I'd like to pay off the loan sooner, I'd choose Loan 1 If I want my payments to remain the same for the duration of the loan, I would pick Loan 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts