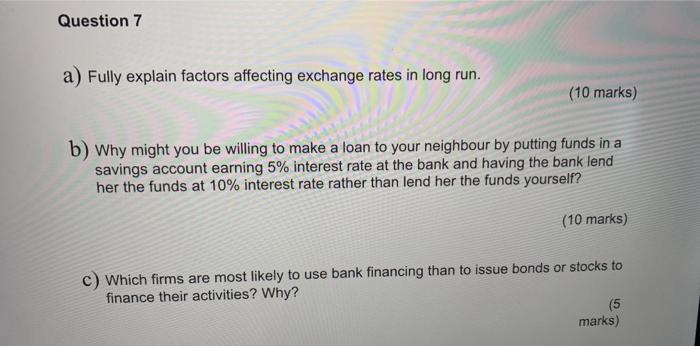

Question: Question 7 a) Fully explain factors affecting exchange rates in long run. (10 marks) b) Why might you be willing to make a loan to

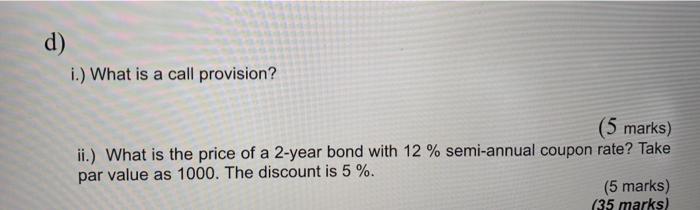

Question 7 a) Fully explain factors affecting exchange rates in long run. (10 marks) b) Why might you be willing to make a loan to your neighbour by putting funds in a savings account earning 5% interest rate at the bank and having the bank lend her the funds at 10% interest rate rather than lend her the funds yourself? (10 marks) c) Which firms are most likely to use bank financing than to issue bonds or stocks to finance their activities? Why? (5 marks) d) i.) What is a call provision? (5 marks) ii.) What is the price of a 2-year bond with 12 % semi-annual coupon rate? Take par value as 1000. The discount is 5 %. (5 marks) (35 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts