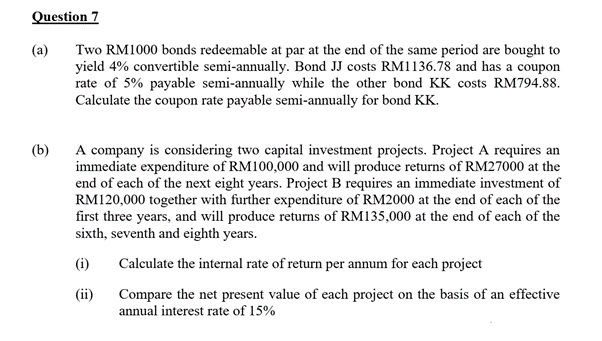

Question: Question 7 ( a ) Two RM 1 0 0 0 bonds redeemable at par at the end of the same period are bought to

Question

a Two RM bonds redeemable at par at the end of the same period are bought to

yield convertible semiannually. Bond JJ costs RM and has a coupon

rate of payable semiannually while the other bond KK costs RM

Calculate the coupon rate payable semiannually for bond

b A company is considering two capital investment projects. Project A requires an

immediate expenditure of RM and will produce returns of RM at the

end of each of the next eight years. Project B requires an immediate investment of

RM together with further expenditure of RM at the end of each of the

first three years, and will produce returns of RM at the end of each of the

sixth, seventh and eighth years.

i Calculate the internal rate of return per annum for each project

ii Compare the net present value of each project on the basis of an effective

annual interest rate of

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock