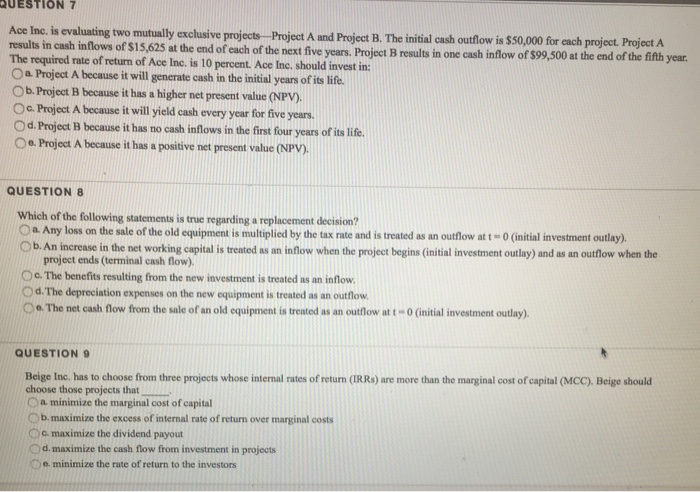

Question: QUESTION 7 Ace Inc. is evaluating two mutually exclusive projects Project A and Project B. The initial cash outflow is $50,000 for each project. Project

QUESTION 7 Ace Inc. is evaluating two mutually exclusive projects Project A and Project B. The initial cash outflow is $50,000 for each project. Project A The required rate of return of Ace Inc. is 10 percent. Ace Inc, should invest in: Oa Project A because it will generate cash in the initial years of its life. Ob. Project B because it has a higher net present value (NPV) Oc. Project A because it will yield cash every year for five years. Od. Project B because it has no cash inflows in the first four years of its life. the end of each of the next five years. Project B results in one cash inflow of $99,500 at the end of the fifth year. O e Project A because it has a positive net present value (NPV) QUESTION 8 Which of the following statements is truc regarding a replacement decision O a. Any loss on the sale of the old equipment is multiplied by the tax rate and is treated as an outflow att - 0 (initial investment outlay). Ob. An increase in the net working capital is treated as an inflow when the project begins (initial investment outlay) and as an outflow when the project ends (terminal cash flow). O c. The benefits resulting from the new investment is treated as an inflow Od. The depreciation expenses on the new equipment is treated as an outflow Oo. The net cash flow from the sale of an old equipment is treated as an outnow at t-o initial investment outlay). QUESTION 9 Beige Inc. has to choose from three projects whose internal rates of return (IRRs) are more than the marginal cost of capital (MCC). Beige should choose those projects that O a minimize the marginal cost of capital Ob. maximize the excess of internal rate of return over marginal costs Oc. maximize the dividend payout O d. maximize the cash flow from investment in projects De. minimize the rate of return to the investors QUESTION 7 Ace Inc. is evaluating two mutually exclusive projects Project A and Project B. The initial cash outflow is $50,000 for each project. Project A The required rate of return of Ace Inc. is 10 percent. Ace Inc, should invest in: Oa Project A because it will generate cash in the initial years of its life. Ob. Project B because it has a higher net present value (NPV) Oc. Project A because it will yield cash every year for five years. Od. Project B because it has no cash inflows in the first four years of its life. the end of each of the next five years. Project B results in one cash inflow of $99,500 at the end of the fifth year. O e Project A because it has a positive net present value (NPV) QUESTION 8 Which of the following statements is truc regarding a replacement decision O a. Any loss on the sale of the old equipment is multiplied by the tax rate and is treated as an outflow att - 0 (initial investment outlay). Ob. An increase in the net working capital is treated as an inflow when the project begins (initial investment outlay) and as an outflow when the project ends (terminal cash flow). O c. The benefits resulting from the new investment is treated as an inflow Od. The depreciation expenses on the new equipment is treated as an outflow Oo. The net cash flow from the sale of an old equipment is treated as an outnow at t-o initial investment outlay). QUESTION 9 Beige Inc. has to choose from three projects whose internal rates of return (IRRs) are more than the marginal cost of capital (MCC). Beige should choose those projects that O a minimize the marginal cost of capital Ob. maximize the excess of internal rate of return over marginal costs Oc. maximize the dividend payout O d. maximize the cash flow from investment in projects De. minimize the rate of return to the investors

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts