Question: Question 7 and 8 Please Answer c). (3 points) You w Du e the value of a three-month European put option on stock with a

Question 7 and 8 Please

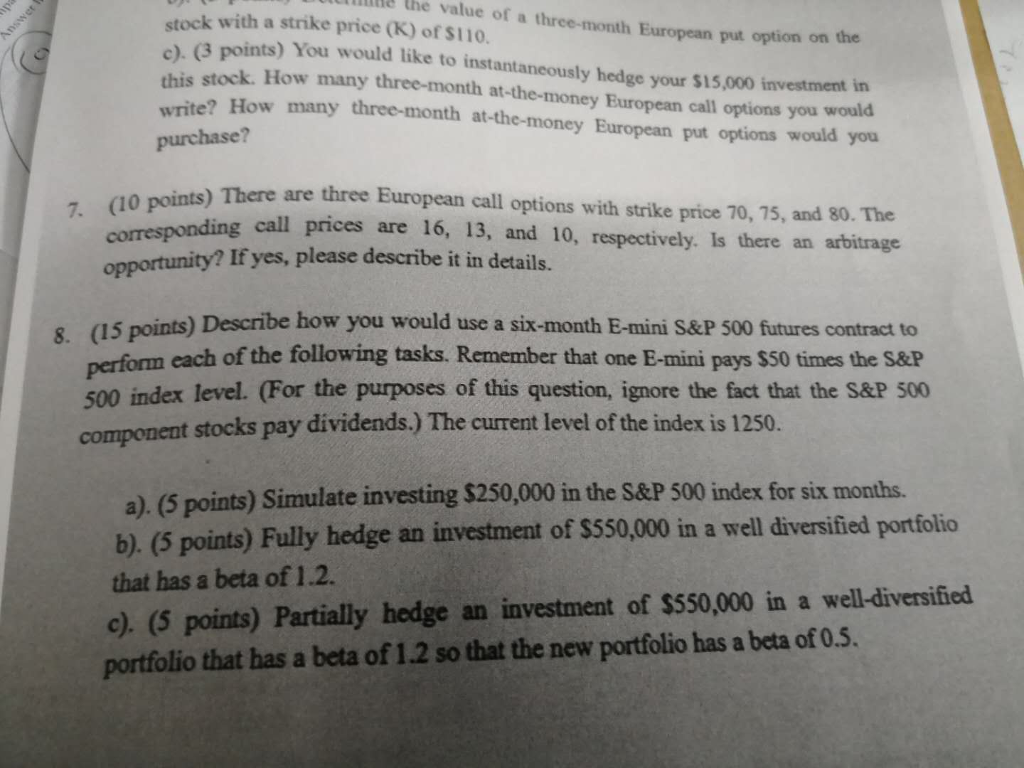

Answer c). (3 points) You w Du e the value of a three-month European put option on stock with a strike price (K) of $110. 13 points) You would like to instantaneously hedge your $15,000 investment in bis stock. How many three-month at-the-money European call options you would e How many three-month at-the-money European put options would you purchase? 7. (10 points) There are points) There are three European call options with strike price 70, 75, and 80. The menonding call prices are 16, 13, and 10, respectively. Is there an arbitrage opportunity? If yes, please describe it in details. 8 (15 points) Describe how you would use a six-month E-mini S&P 500 futures contract to perform each of woo Derfor each of the following tasks. Remember that one E-mini pays $50 times the S&P 500 index level. (For the purposes of this question, ignore the fact that the S&P 500 component stocks pay dividends.) The current level of the index is 1250. a). (5 points) Simulate investing $250,000 in the S&P 500 index for six months. b). (5 points) Fully hedge an investment of $550,000 in a well diversified portfolio that has a beta of 1.2. c). (5 points) Partially hedge an investment of $550,000 in a well-diversified portfolio that has a beta of 1.2 so that the new portfolio has a beta of 0.5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts