Question: Question 7 [ Answer BOTH subsections] a) The Goldstein family have 3 children: Samantha is 8, Marcus is 16, Steph is 22 and has moved

![Question 7 [ Answer BOTH subsections] a) The Goldstein family have](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/670114d7cde1d_119670114d739997.jpg)

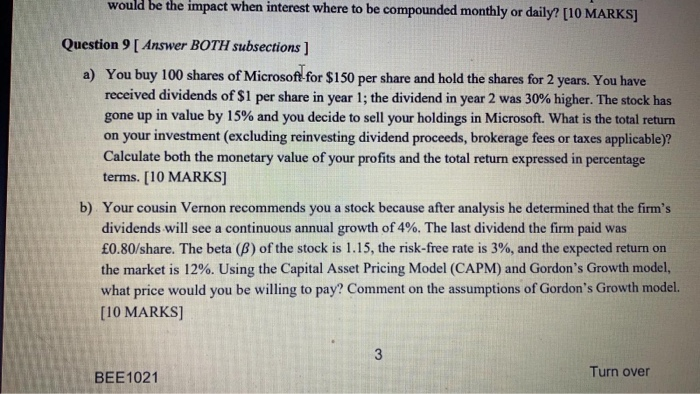

Question 7 [ Answer BOTH subsections] a) The Goldstein family have 3 children: Samantha is 8, Marcus is 16, Steph is 22 and has moved out of the family home to start her first job. Mr. and Mrs Goldstein earn combined a gross salary of 50,000. Their average tax rate including all deductions is 20% Calculate their equivalised household income. How does the Goldstein's equivalised household income compare to a couple with the same gross income and tax rate, but without children? Explain why equivalising income is important. [10 MARKS] b) What is the future value of 80,000 in 3 years at an interest rate of 3% per annum? Compare the effect of compound interest to non-compound interest. Explain why compound interest is a cornerstone of personal finance. [10 MARKS] Question 8 [ Answer BOTH subsections] a) You are 8,000 in debt to your credit card company and they allow you to pay off the debt at a rate of 200/month while charging you an APR of 18%. How many months will it take you to pay off this debt? What would be the impact when you increase or decrease your monthly payments? What would be the impact when the APR increases or decreases? [10 MARKS] b) You have 5,000 of debt on a personal loan with an interest rate of 15% compounded annually. Assuming you don't pay any of it off, how many years will it take for this debt to triple. What would be the impact when interest where to be compounded monthly or daily? [10 MARKS] Question der ROTH suhertinus 1 would be the impact when interest where to be compounded monthly or daily? [10 MARKS] Question 9 [ Answer BOTH subsections ] a) You buy 100 shares of Microsoftfor $150 per share and hold the shares for 2 years. You have received dividends of $1 per share in year 1; the dividend in year 2 was 30% higher. The stock has gone up in value by 15% and you decide to sell your holdings in Microsoft. What is the total return on your investment (excluding reinvesting dividend proceeds, brokerage fees or taxes applicable)? Calculate both the monetary value of your profits and the total return expressed in percentage terms. [10 MARKS] b) Your cousin Vernon recommends you a stock because after analysis he determined that the firm's dividends will see a continuous annual growth of 4%. The last dividend the firm paid was 0.80/share. The beta () of the stock is 1.15, the risk-free rate is 3%, and the expected return on the market is 12%. Using the Capital Asset Pricing Model (CAPM) and Gordon's Growth model, what price would you be willing to pay? Comment on the assumptions of Gordon's Growth model. [10 MARKS] BEE 1021 Turn over

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts