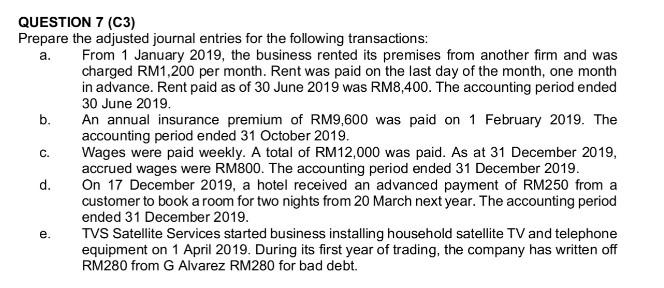

Question: QUESTION 7 (C3) Prepare the adjusted journal entries for the following transactions: a. b. C. d. e. From 1 January 2019, the business rented

QUESTION 7 (C3) Prepare the adjusted journal entries for the following transactions: a. b. C. d. e. From 1 January 2019, the business rented its premises from another firm and was charged RM1,200 per month. Rent was paid on the last day of the month, one month in advance. Rent paid as of 30 June 2019 was RM8,400. The accounting period ended 30 June 2019. An annual insurance premium of RM9,600 was paid on 1 February 2019. The accounting period ended 31 October 2019. Wages were paid weekly. A total of RM12,000 was paid. As at 31 December 2019, accrued wages were RM800. The accounting period ended 31 December 2019. On 17 December 2019, a hotel received an advanced payment of RM250 from a customer to book a room for two nights from 20 March next year. The accounting period ended 31 December 2019. TVS Satellite Services started business installing household satellite TV and telephone equipment on 1 April 2019. During its first year of trading, the company has written off RM280 from G Alvarez RM280 for bad debt.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts