Question: QUESTION 7 ( CHAPTER 1 8 ) Brian Johns is contributing real estate to a wholly - owned corporation during formation in exchange for all

QUESTION CHAPTER

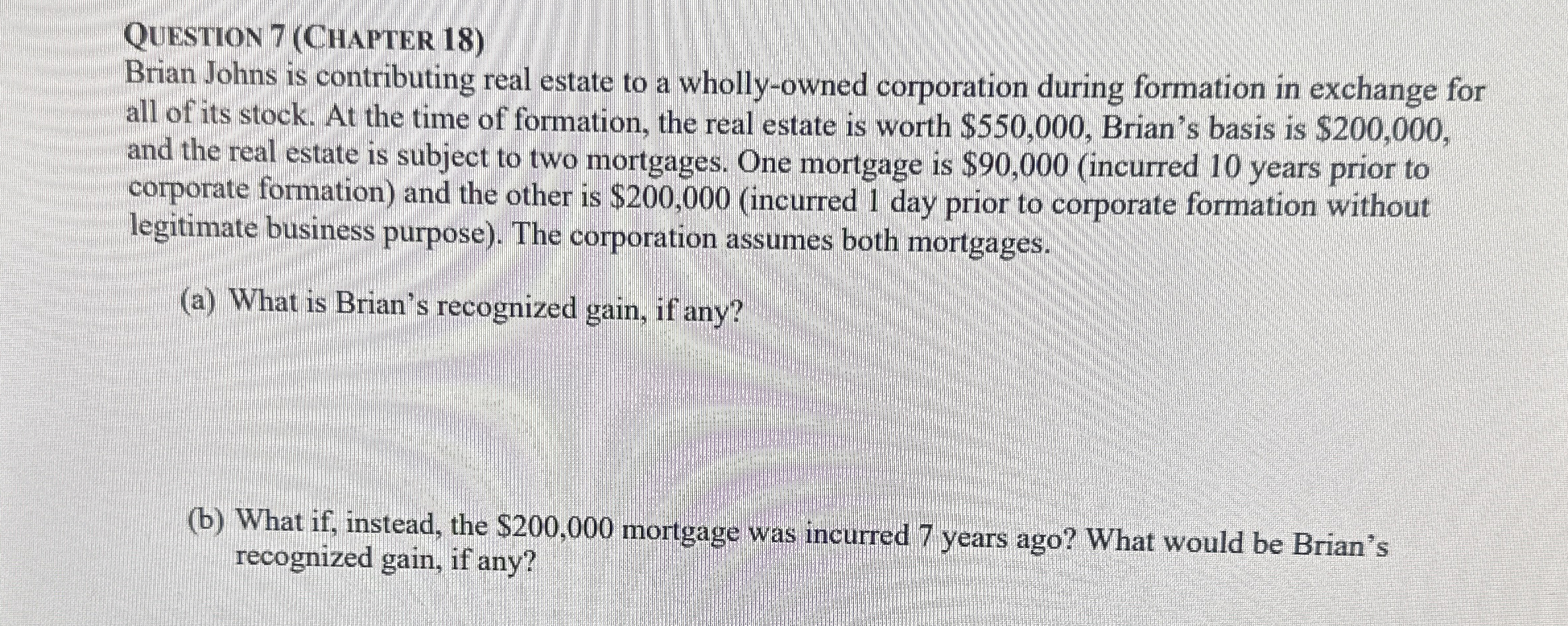

Brian Johns is contributing real estate to a whollyowned corporation during formation in exchange for all of its stock. At the time of formation, the real estate is worth $ Brian's basis is $ and the real estate is subject to two mortgages. One mortgage is $incurred years prior to corporate formation and the other is $incurred day prior to corporate formation without legitimate business purpose The corporation assumes both mortgages.

a What is Brian's recognized gain, if any?

b What if instead, the $ mortgage was incurred years ago? What would be Brian's recognized gain, if any?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock