Question: QUESTION 7 Consider a bond with a par value of 1,000 paying a coupon rate of 79 months from now after the next coupon is

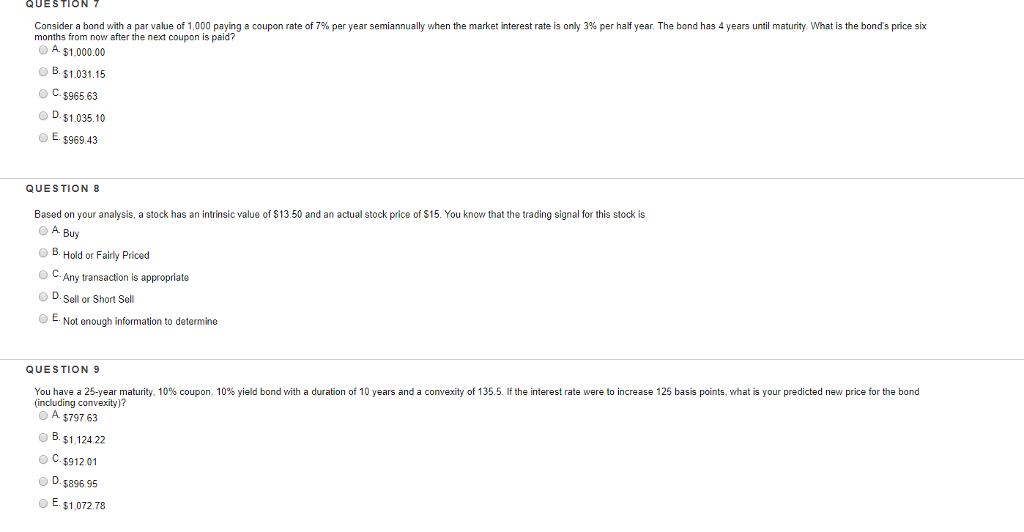

QUESTION 7 Consider a bond with a par value of 1,000 paying a coupon rate of 79 months from now after the next coupon is paid? per year semiannually when the market interest rate is only 3% per half year The bond has 4 years until maturity What is the bond's price six A $1.000.00 B. $1.031.15 O C.$965.63 D.$1035.10 E. $969.43 QUESTION 8 Based on your analysis, a stock has an intrinsic value of $13.50 and an actual stock price of $15. You know that the trading signal for this stock is A. Buy B. Hold or Fairly Priced O C Any transaction is appropriate D.Sell or Short Sell OE. Not enough information to determine You have a 25-year maturity. 10% coupon 10% yield bond with a duration of 10 years and a convexity of 135.5. H the interest rate were to increase 125 basis points. what is your predicted new price for the bond (including convexity)? QUESTION 9 O A $797.63 B. $1.124.22 C.$912.01 D. $896 95 E. $1,072.78

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts