Question: Question 7 Consider Mutually Exclusive Projects A and B with projected cash flows as follows: Projet FM FM: FM2 FM A -500 000 $ -500

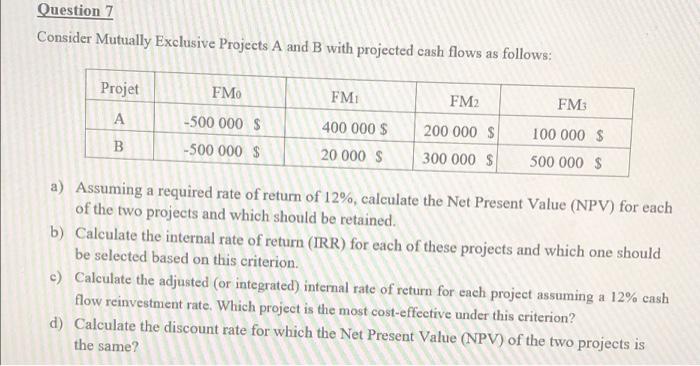

Question 7 Consider Mutually Exclusive Projects A and B with projected cash flows as follows: Projet FM FM: FM2 FM A -500 000 $ -500 000 $ 200 000 $ 400 000 $ 20 000 S 100 000 $ B 300 000 $ 500 000 $ a) Assuming a required rate of return of 12%, calculate the Net Present Value (NPV) for each of the two projects and which should be retained. b) Calculate the internal rate of return (IRR) for each of these projects and which one should be selected based on this criterion. c) Calculate the adjusted (or integrated) internal rate of return for each project assuming a 12% cash flow reinvestment rate. Which project is the most cost-effective under this criterion? d) Calculate the discount rate for which the Net Present Value (NPV) of the two projects is the same

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts