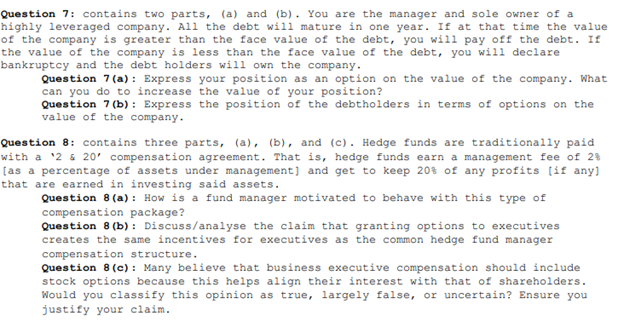

Question: Question 7 : contains two parts, ( a ) and ( b ) . You are the manager and sole owner of a highly leveraged

Question : contains two parts, a and b You are the manager and sole owner of a

highly leveraged company. All the debt will mature in one year. If at that time the value

of the company is greater than the face value of the debt, you will pay off the debt. If

the value of the company is less than the face value of the debt, you will declare

bankruptcy and the debt holders will own the company.

Question a : Express your position as an option on the value of the company. What

can you do to increase the value of your position?

Question b : Express the position of the debtholders in terms of options on the

value of the company.

Question : contains three parts, ab and c Hedge funds are traditionally paid

with a & compensation agreement. That is hedge funds earn a management fee of

as a percentage of assets under management and get to keep of any profits if any

that are earned in investing said assets.

Question a : How is a fund manager motivated to behave with this type of

compensation package?

Question b: Discussanalyse the claim that granting options to executives

creates the same incentives for executives as the common hedge fund manager

compensation structure.

Question c : Many believe that business executive compensation should include

stock options because this helps align their interest with that of shareholders.

Would you classify this opinion as true, largely false, or uncertain? Ensure you

justify your claim.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock