Question: Question 7 Efficient Markets Hypothesis Pollutotech Ltd has been defending itself in a court case and may have to pay substantial damages if it is

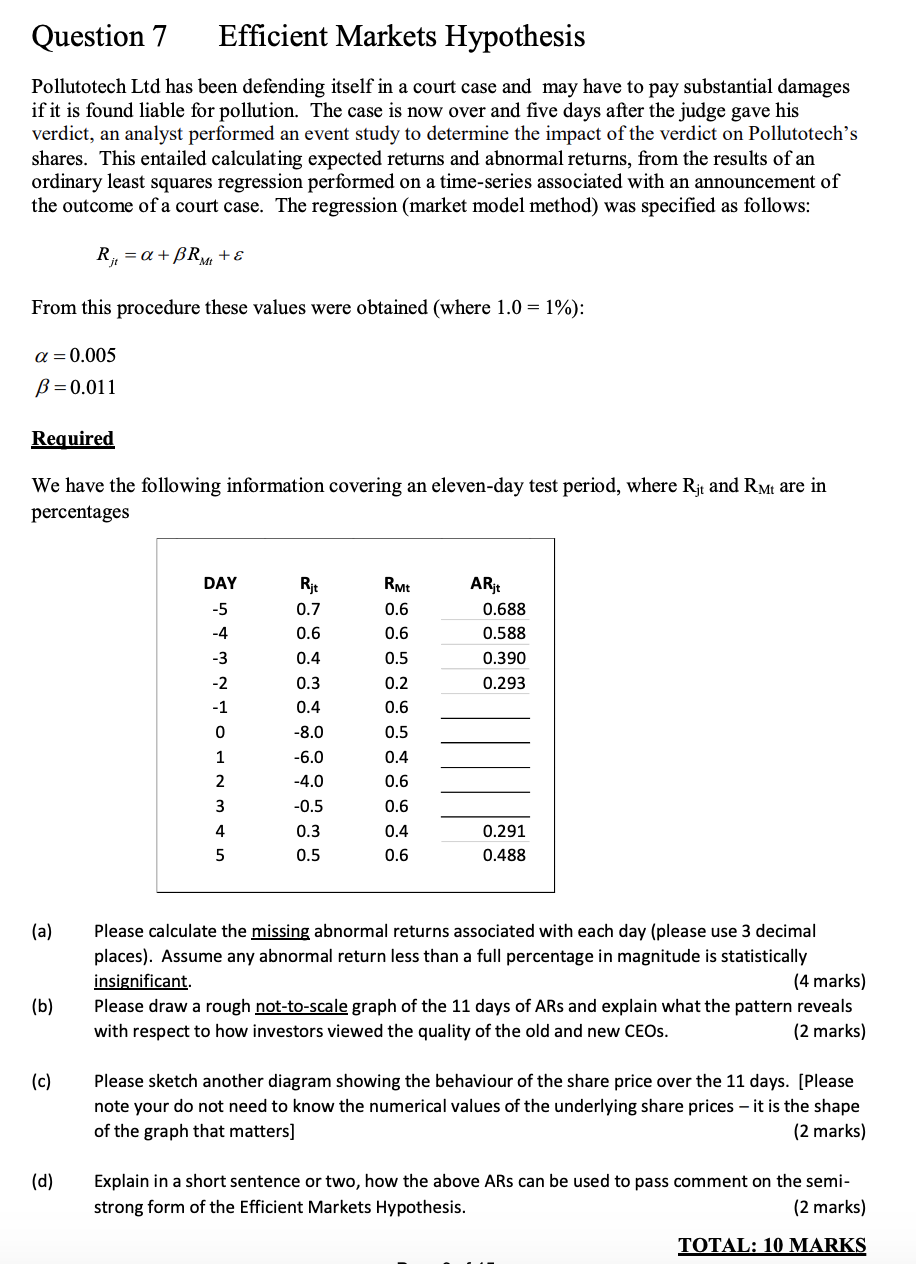

Question 7 Efficient Markets Hypothesis Pollutotech Ltd has been defending itself in a court case and may have to pay substantial damages if it is found liable for pollution. The case is now over and five days after the judge gave his verdict, an analyst performed an event study to determine the impact of the verdict on Pollutotech's shares. This entailed calculating expected returns and abnormal returns, from the results of an ordinary least squares regression performed on a time-series associated with an announcement of the outcome of a court case. The regression (market model method) was specified as follows: RI = a + BRM + E From this procedure these values were obtained (where 1.0 = 1%): a=0.005 B=0.011 Required We have the following information covering an eleven-day test period, where Rjt and RMt are in percentages DAY -5 -4 Rjt 0.7 0.6 0.4 0.3 0.4 on -3 AR; 0.688 0.588 0.390 0.293 RMt 0.6 0.6 0.5 0.2 0.6 0.5 0.4 0.6 -2 -1 -8.0 1 2 3 -6.0 -4.0 -0.5 0.3 0.5 0.6 4 0.4 0.6 0.291 0.488 5 (a) ( Please calculate the missing abnormal returns associated with each day (please use 3 decimal places). Assume any abnormal return less than a full percentage in magnitude is statistically insignificant (4 marks) Please draw a rough not-to-scale graph of the 11 days of ARs and explain what the pattern reveals with respect to how investors viewed the quality of the old and new CEOs. (2 marks) (b) ( (c) Please sketch another diagram showing the behaviour of the share price over the 11 days. (Please note your do not need to know the numerical values of the underlying share prices - it is the shape of the graph that matters] (2 marks) (d) Explain in a short sentence or two, how the above Ars can be used to pass comment on the semi- strong form of the Efficient Markets Hypothesis. (2 marks) TOTAL: 10 MARKS Question 7 Efficient Markets Hypothesis Pollutotech Ltd has been defending itself in a court case and may have to pay substantial damages if it is found liable for pollution. The case is now over and five days after the judge gave his verdict, an analyst performed an event study to determine the impact of the verdict on Pollutotech's shares. This entailed calculating expected returns and abnormal returns, from the results of an ordinary least squares regression performed on a time-series associated with an announcement of the outcome of a court case. The regression (market model method) was specified as follows: RI = a + BRM + E From this procedure these values were obtained (where 1.0 = 1%): a=0.005 B=0.011 Required We have the following information covering an eleven-day test period, where Rjt and RMt are in percentages DAY -5 -4 Rjt 0.7 0.6 0.4 0.3 0.4 on -3 AR; 0.688 0.588 0.390 0.293 RMt 0.6 0.6 0.5 0.2 0.6 0.5 0.4 0.6 -2 -1 -8.0 1 2 3 -6.0 -4.0 -0.5 0.3 0.5 0.6 4 0.4 0.6 0.291 0.488 5 (a) ( Please calculate the missing abnormal returns associated with each day (please use 3 decimal places). Assume any abnormal return less than a full percentage in magnitude is statistically insignificant (4 marks) Please draw a rough not-to-scale graph of the 11 days of ARs and explain what the pattern reveals with respect to how investors viewed the quality of the old and new CEOs. (2 marks) (b) ( (c) Please sketch another diagram showing the behaviour of the share price over the 11 days. (Please note your do not need to know the numerical values of the underlying share prices - it is the shape of the graph that matters] (2 marks) (d) Explain in a short sentence or two, how the above Ars can be used to pass comment on the semi- strong form of the Efficient Markets Hypothesis. (2 marks) TOTAL: 10 MARKS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts