Question: Question 7 - Homework: Account + X C https://ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=08launchUrl=https%253A%252F%252Fnewconnect.mheducati.. Homework: Accounting Changes & Error Corrections Assignment @ Saved Help Save & Exit Submit Check my

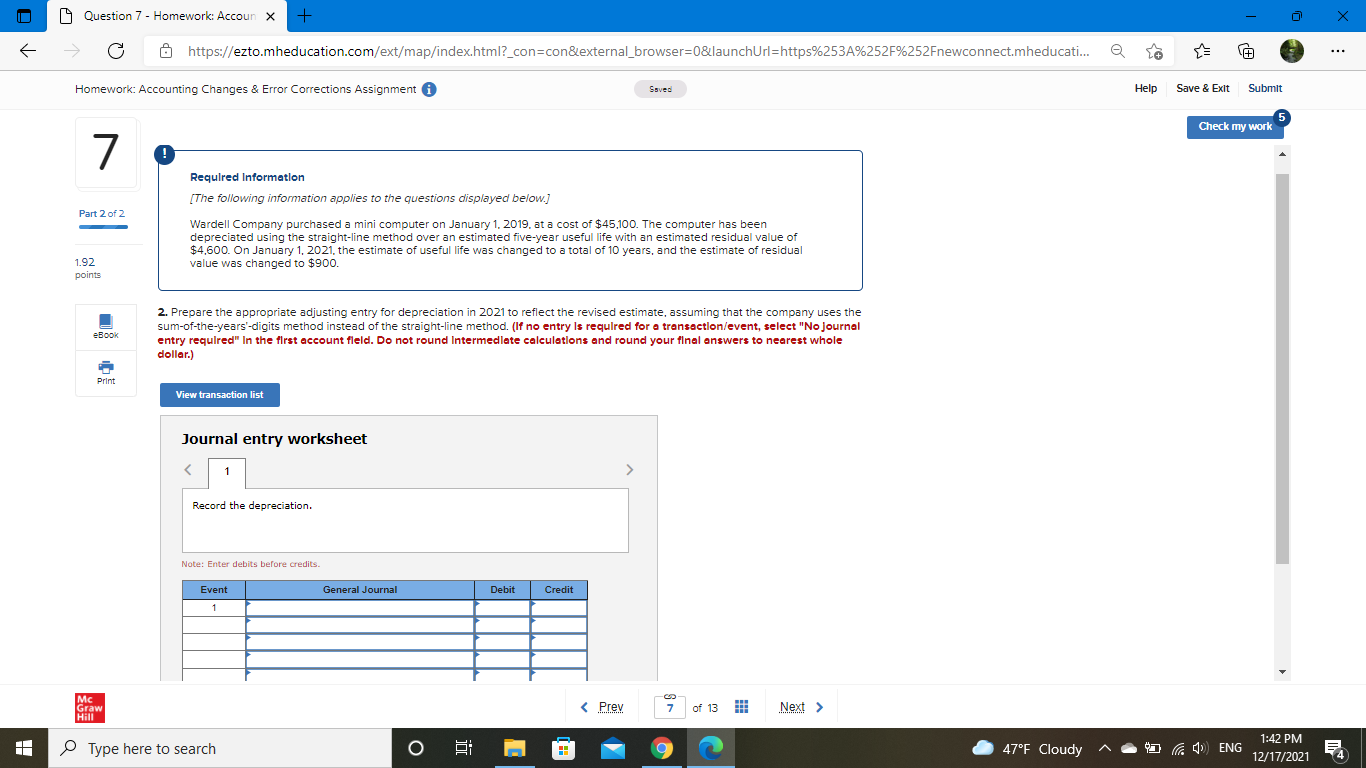

Question 7 - Homework: Account + X C https://ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=08launchUrl=https%253A%252F%252Fnewconnect.mheducati.. Homework: Accounting Changes & Error Corrections Assignment @ Saved Help Save & Exit Submit Check my work 7 Required Information [The following information applies to the questions displayed below.] Part 2 of 2 Wardell Company purchased a mini computer on January 1. 2019. at a cost of $45,100. The computer has been depreciated using the straight-line method over an estimated five-year useful life with an estimated residual value of $4,600. On January 1, 2021. the estimate of useful life was changed to a total of 10 years, and the estimate of residual 1.92 value was changed to $900. points 2. Prepare the appropriate adjusting entry for depreciation in 2021 to reflect the revised estimate, assuming that the company uses the eBook sum-of-the-years'-digits method instead of the straight-line method. (If no entry Is required for a transaction/event, select "No journal entry required" In the first account field. Do not round Intermediate calculations and round your final answers to nearest whole dollar.) Print View transaction list Journal entry worksheet Record the depreciation. Note: Enter debits before credits. Event General Journal Debit Credit Mc Graw Type here to search M 1:42 PM O 47.F Cloudy ~ 5 / ENG 12/17/2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts