Question: Question 7 (Mandatory) (1 point) When firms use multiple sources of capital, they need to calculate the appropriate discount rate for valuing their firm's cash

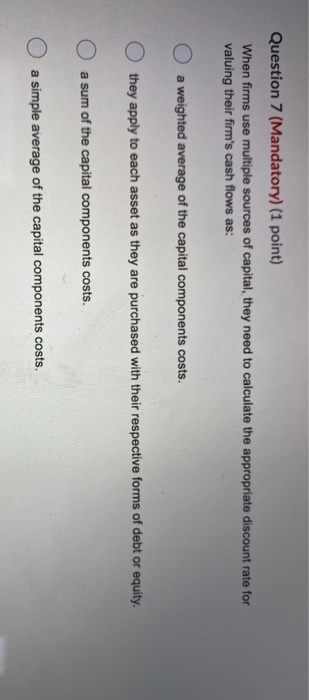

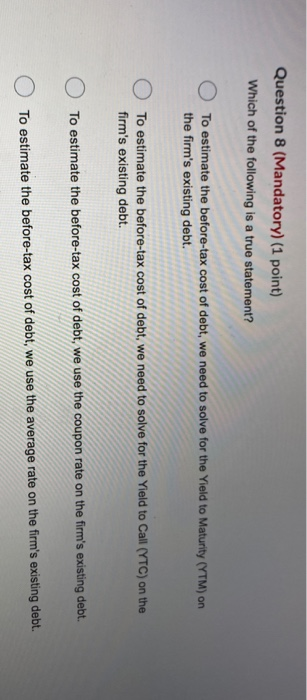

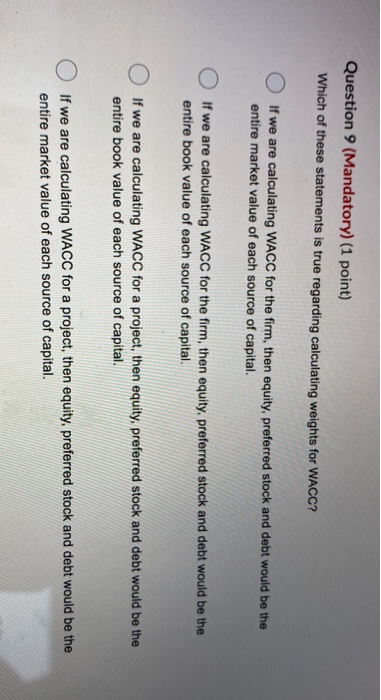

Question 7 (Mandatory) (1 point) When firms use multiple sources of capital, they need to calculate the appropriate discount rate for valuing their firm's cash flows as: O a weighted average of the capital components costs. O they apply to each asset as they are purchased with their respective forms of debt or equity. O a sum of the capital components costs. O a simple average of the capital components costs. Question 8 (Mandatory) (1 point) Which of the following is a true statement? O To estimate the before-tax cost of debt, we need to solve for the Yield to Maturity (YTM) on the firm's existing debt. O To estimate the before-tax cost of debt, we need to solve for the Yield to Call (YTC) on the firm's existing debt. O To estimate the before-tax cost of debt, we use the coupon rate on the firm's existing debt. O To estimate the before-tax cost of debt, we use the average rate on the firm's existing debt. Question 9 (Mandatory) (1 point) Which of these statements is true regarding calculating weights for WACC? 0 If we are calculating WACC for the firm, then equity, preferred stock and debt would be the entire market value of each source of capital. If we are calculating WACC for the firm, then equity, preferred stock and debt would be the entire book value of each source of capital. If we are calculating WACC for a project, then equity, preferred stock and debt would be the entire book value of each source of capital. O If we are calculating WACC for a project, then equity, preferred stock and debt would be the entire market value of each source of capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts