Question: Question 7 Morris Philippe Corp. Is financed by two sources of funds: bonds and common stock. The capital structure is $1600000 for bonds and 51900000

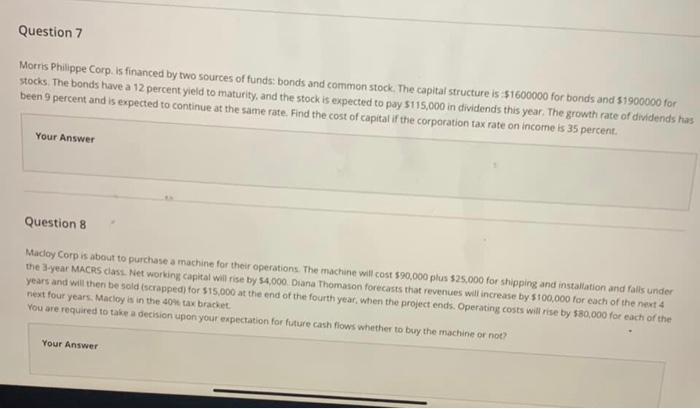

Question 7 Morris Philippe Corp. Is financed by two sources of funds: bonds and common stock. The capital structure is $1600000 for bonds and 51900000 for stocks. The bonds have a 12 percent yield to maturity, and the stock is expected to pay $115,000 in dividends this year. The growth rate of dividends has been 9 percent and is expected to continue at the same rate. Find the cost of capital if the corporation tax rate on income is 35 percent. Your Answer Question 8 Macoy Corp is about to purchase a machine for their operations. The machine will cost $90,000 plus $25.000 for shipping and installation and falls under the 3-year MACRS class. Net working capital will rise by 54.000. Diana Thomason forecasts that revenues will increase by $100,000 for each of the next 4 years and will then be sold (scrapped) for $15,000 at the end of the fourth year, when the project ends. Operating costs will rise by $80,000 for each of the next four years. Macloy is in the con tax bracket You are required to take a decision upon your expectation for future cash flows whether to buy the machine or not? Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts