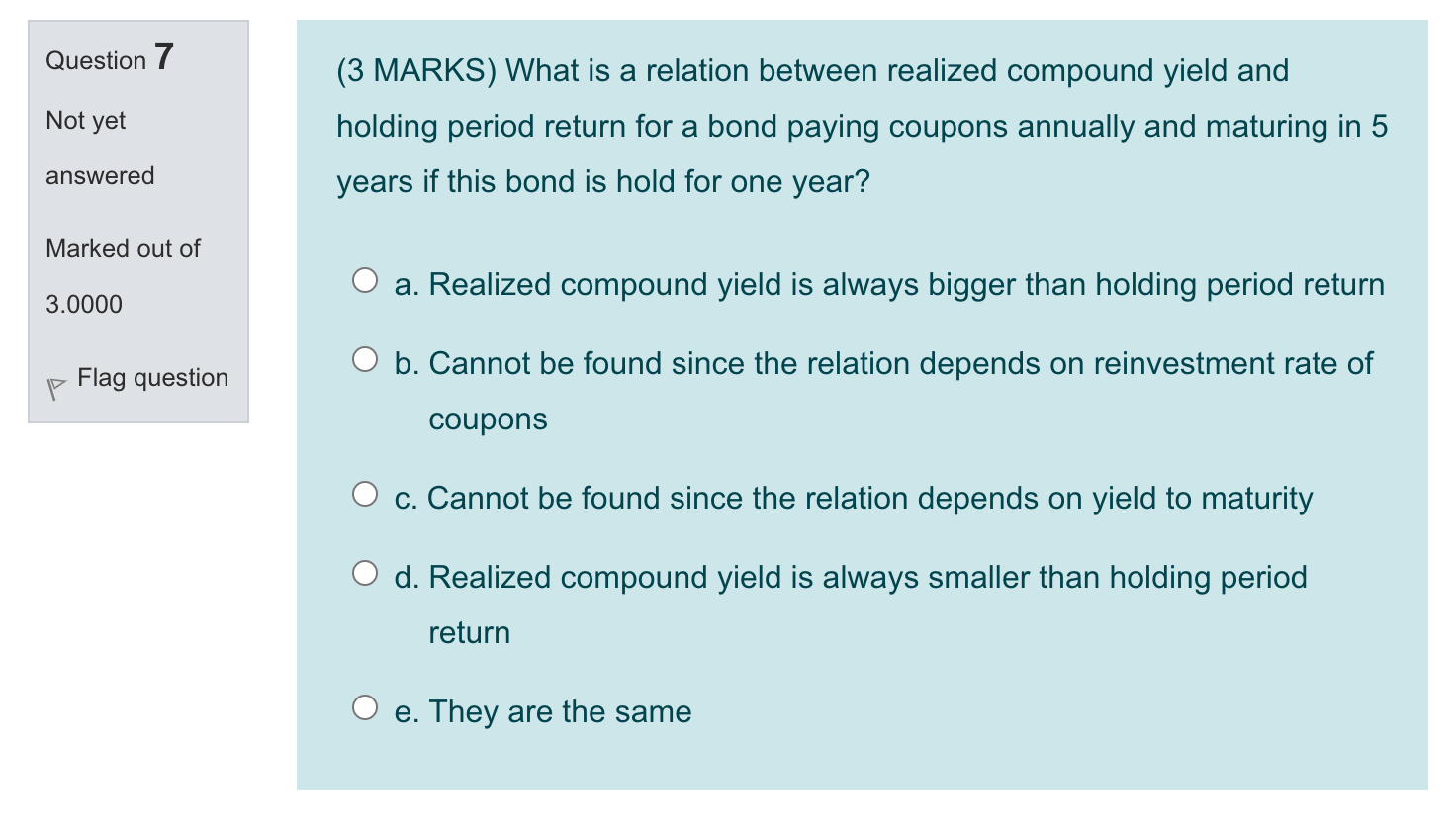

Question: Question 7 Not yet (3 MARKS) What is a relation between realized compound yield and holding period return for a bond paying coupons annually and

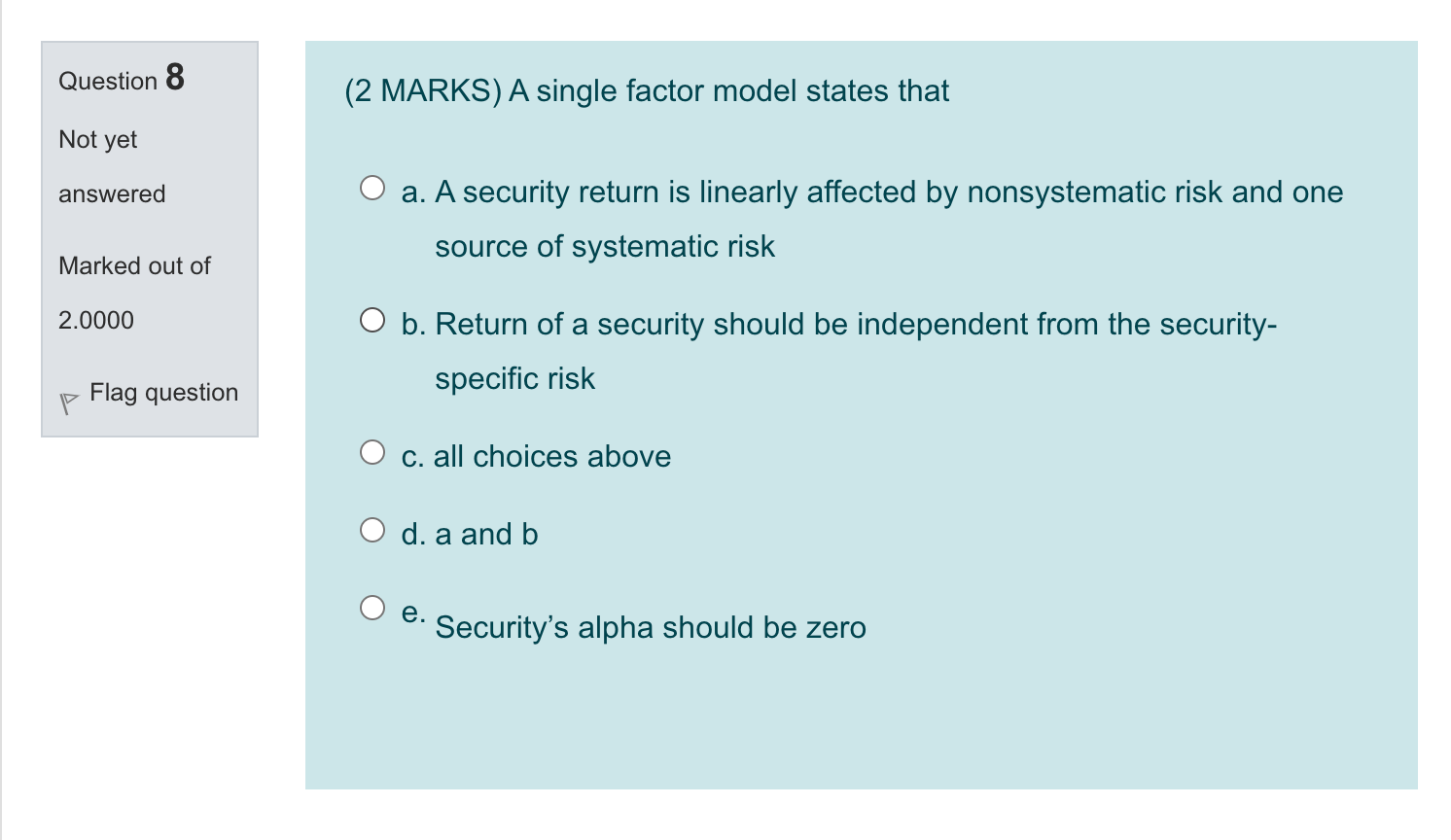

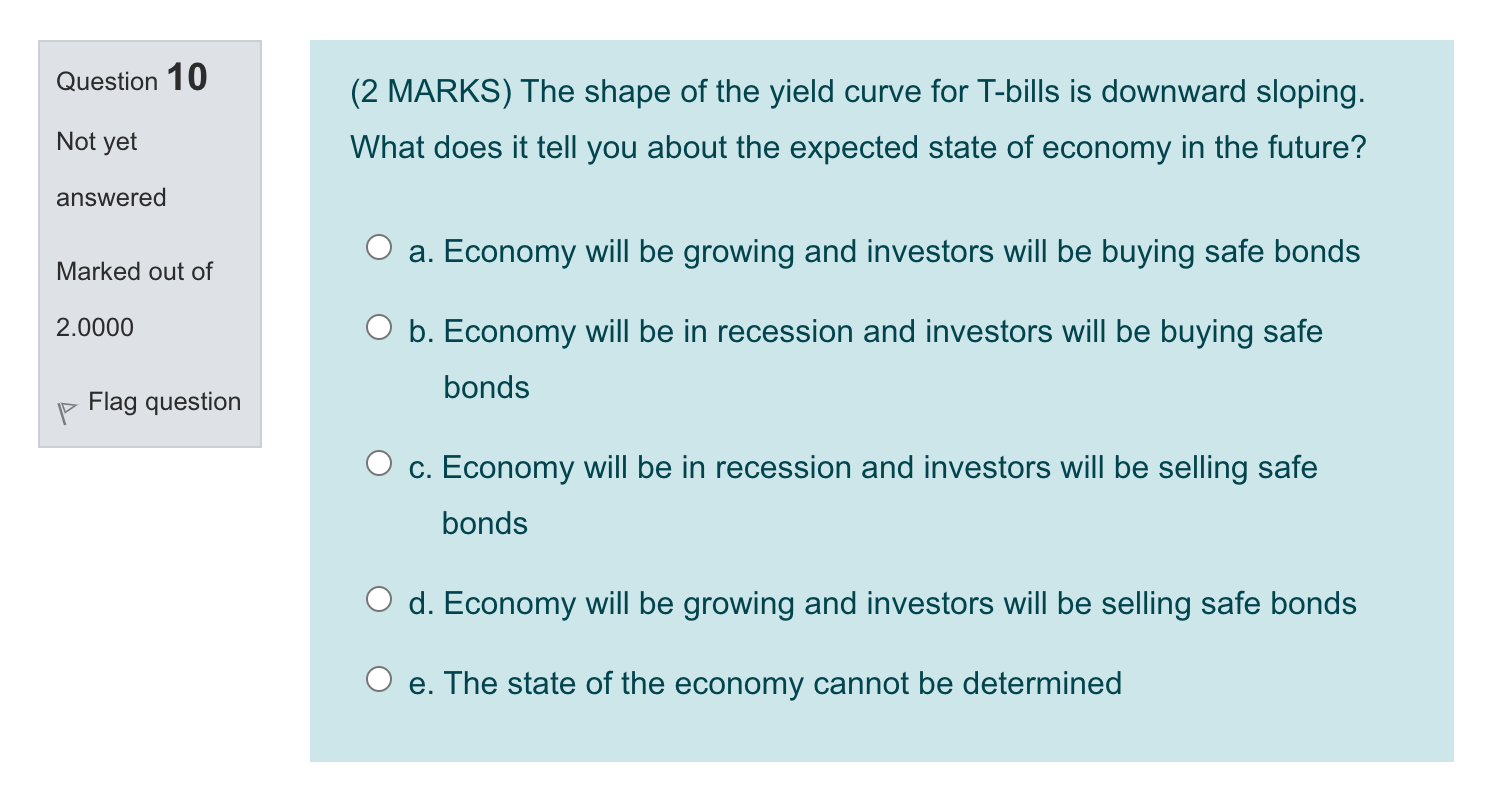

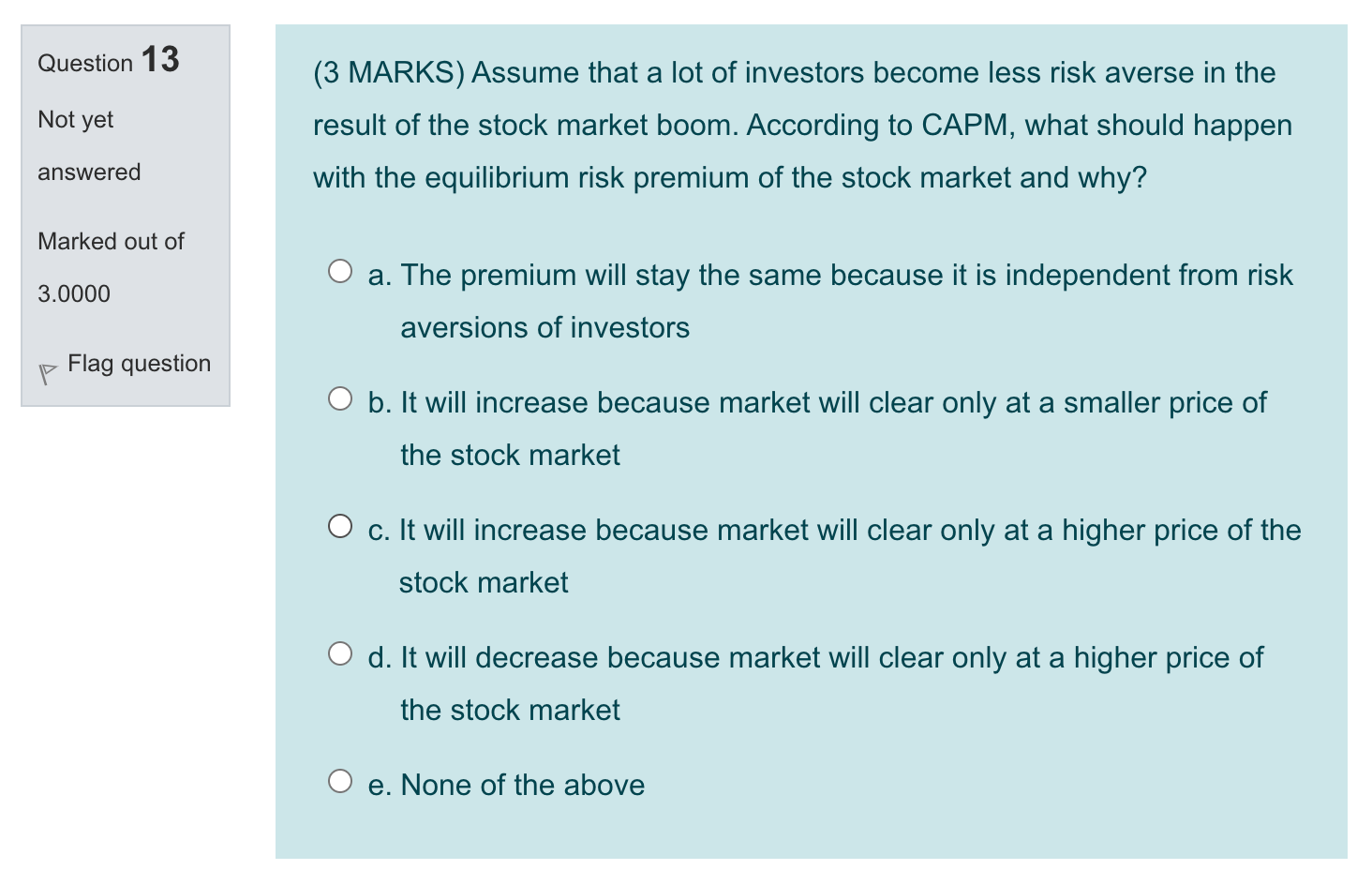

Question 7 Not yet (3 MARKS) What is a relation between realized compound yield and holding period return for a bond paying coupons annually and maturing in 5 years if this bond is hold for one year? answered Marked out of a. Realized compound yield is always bigger than holding period return 3.0000 Flag question O b. Cannot be found since the relation depends on reinvestment rate of coupons c. Cannot be found since the relation depends on yield to maturity d. Realized compound yield is always smaller than holding period return e. They are the same Question 8 (2 MARKS) A single factor model states that Not yet answered O a. A security return is linearly affected by nonsystematic risk and one source of systematic risk Marked out of 2.0000 O b. Return of a security should be independent from the security- specific risk Flag question c. all choices above d. a and b e. Security's alpha should be zero Question 10 (2 MARKS) The shape of the yield curve for T-bills is downward sloping. What does it tell you about the expected state of economy in the future? Not yet answered a. Economy will be growing and investors will be buying safe bonds Marked out of 2.0000 O b. Economy will be in recession and investors will be buying safe bonds Flag question c. Economy will be in recession and investors will be selling safe bonds d. Economy will be growing and investors will be selling safe bonds e. The state of the economy cannot be determined Question 13 Not yet (3 MARKS) Assume that a lot of investors become less risk averse in the result of the stock market boom. According to CAPM, what should happen with the equilibrium risk premium of the stock market and why? answered Marked out of 3.0000 a. The premium will stay the same because it is independent from risk aversions of investors Flag question O b. It will increase because market will clear only at a smaller price of the stock market O c. It will increase because market will clear only at a higher price of the stock market O d. It will decrease because market will clear only at a higher price of the stock market O e. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts