Question: Question 7 of 50 -/2 E View Policies Current Attempt in Progress Thomas just graduated from college and has started his first job in sales.

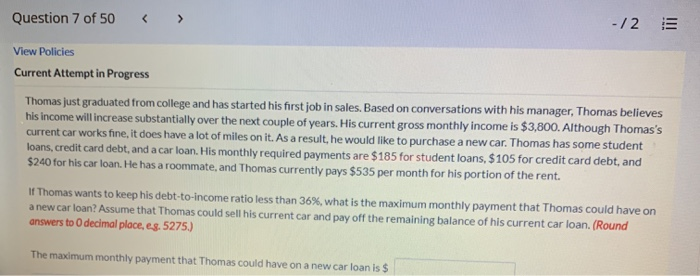

Question 7 of 50 -/2 E View Policies Current Attempt in Progress Thomas just graduated from college and has started his first job in sales. Based on conversations with his manager, Thomas believes his income will increase substantially over the next couple of years. His current gross monthly income is $3,800. Although Thomas's current car works fine, it does have a lot of miles on it. As a result, he would like to purchase a new car. Thomas has some student loans, credit card debt, and a car loan. His monthly required payments are $185 for student loans, $105 for credit card debt, and $240 for his car loan. He has a roommate, and Thomas currently pays $535 per month for his portion of the rent. If Thomas wants to keep his debt-to-Income ratio less than 36%, what is the maximum monthly payment that Thomas could have on a new car loan? Assume that Thomas could sell his current car and pay off the remaining balance of his current car loan. (Round answers to decimal place, es. 5275.) The maximum monthly payment that Thomas could have on a new car loan is $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts