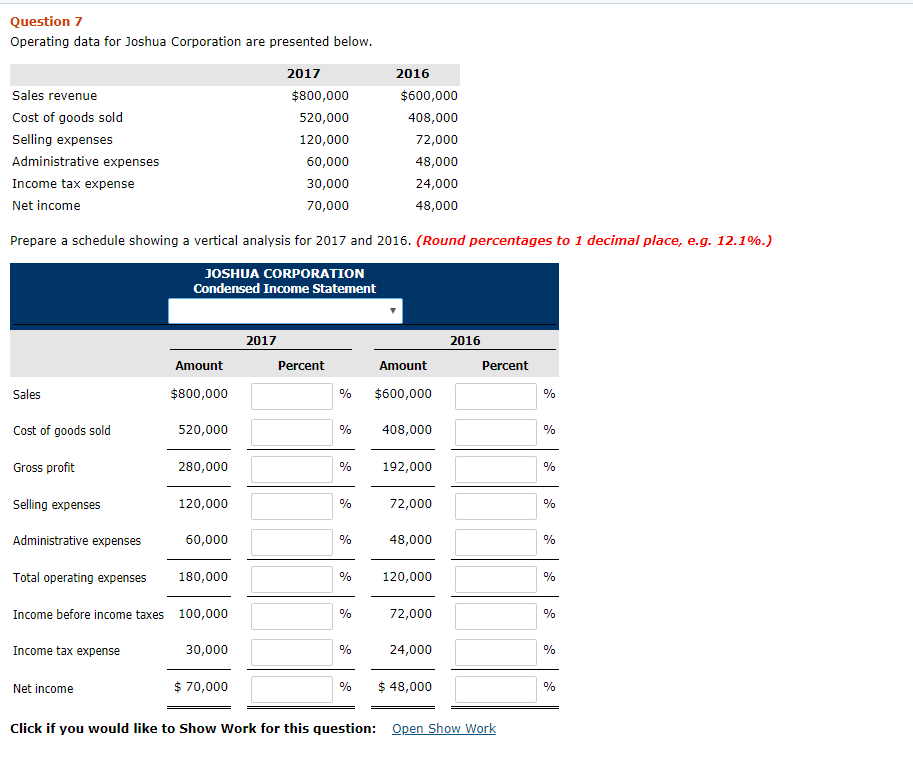

Question: Question 7 Operating data for Joshua Corporation are presented below 2017 2016 $600,000 408,000 72,000 48,000 24,000 48,000 Sales revenue Cost of goods sold Selling

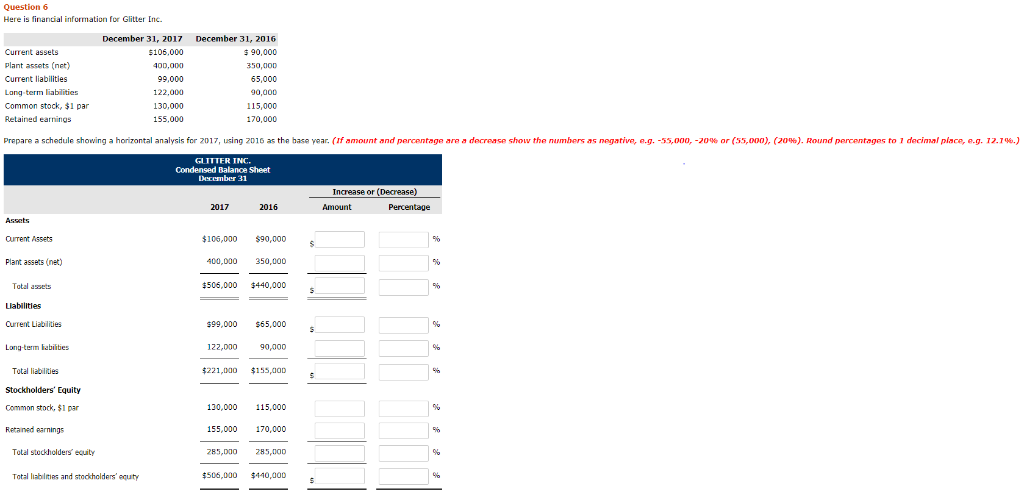

Question 7 Operating data for Joshua Corporation are presented below 2017 2016 $600,000 408,000 72,000 48,000 24,000 48,000 Sales revenue Cost of goods sold Selling expenses Administrative expenses Income tax expense Net income $800,000 520,000 120,000 60,000 30,000 70,000 Prepare a schedule showing a vertical analysis for 2017 and 2016, (Round percentages to 1 decimal place, e.g. 12.1%.) OSHUA CORPORATION Condensed Income Statement 2017 2016 Amount $800,000 520,000 280,000 120,000 60,000 180,000 Income before income taxes 100,000 30,000 $70,000 Percent Amount % $600,000 % 408,000 % 192,000 72,000 48,000 % 120,000 72,000 24,000 % $.48,000 Percent Sales Cost of goods sold Gross profit Selling expenses Administrative expenses Total operating expenses Income tax expense Net income Click if you would like to Show Work for this question: Open Show Work Question 6 Here is finantial information for Glitter Inc. December 31, 2017 $106,000 December 31, 2016 90,000 350,000 Current assets Plant assets (net) Current liabilities Long-term liabilities Common stock, $1 par Retained earnings 99,000 122,000 130,000 155,000 0,000 115,000 170,000 Prepare a schedule showing a ho zo tal analysis r 2017, using 2016 as the base year. 1 amount and percentage are de re se show the number as negative, e Round percentages to 1 decemal place, e g 55,000, 20 55 000 20 12.79 or GLTTTER INC Condensed Balance Sheet December 31 Increase or (Decrease) 2017 2016 Amount CurTent Assets $106,000 $90,000 Plant assets (net) 400,000 350,000 $506,000 $440,000 Total assets Ourrent Liabilities $99,000 $5,000 122,000 90,000 221,000 $155,000s Long-term labilities Total liabilties Stockholders' Equity Common stock, $1 par Retaned earnings 130,000 115,000 155,000 170,000 83,D0 285,O0D $506,000 40,000 Total stockholders equity Total lablies and stockholders equty

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts