Question: Question 7. PART 1 - 16 QUESTION. DO ALL PARTS. I WILL GIVE A RATING. Find the return on equity using three components of DuPont

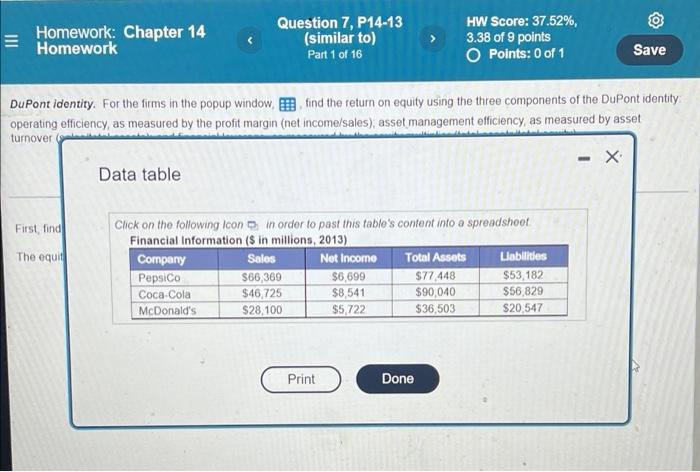

Fl 302 Spring 2022 ONLINE Des Homework: 3 Chapter 14 Homework Question 7, P14-13 (similar to) Part 1 of 16 HW Score: 37.52%, 3.38 of 9 points O Points: 0 of 1 Save DuPont identity. For the firms in the popup window, find the return on equity using the three components of the DuPont identity operating efficiency, as measured by the profit margin (net income/sales); asset management efficiency as measured by asset turnover (sales/total assets), and financial leverage, as measured by the equity multiplier (total assets/total equity). First, find the equity of each company The equity for PepsiCo is $ million (Round to the nearest million dollars.) Homework: Chapter 14 Homework Question 7, P14-13 (similar to) Part 1 of 16 HW Score: 37.52%, 3.38 of 9 points Points: 0 of 1 Save DuPont Identity. For the firms in the popup window I find the return on equity using the three components of the DuPont identity operating efficiency, as measured by the profit margin (net income/sales), asset management officiency, as measured by asset turnover - X Data table First, find The equil Click on the following icon in order to past this table's content into a spreadsheet Financial Information (S in millions, 2013) Company Sales Not Income Total Assets Liabilities PepsiCo $66,369 $6,699 $77 448 $53,182 Coca Cola $46,725 $8,541 $90,040 $56,829 McDonald's $28,100 $5,722 $36,503 $20 547 Print Done First, find the equity of each company. The equity for PepsiCo is $ million. (Round to the nearest million dollars.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts