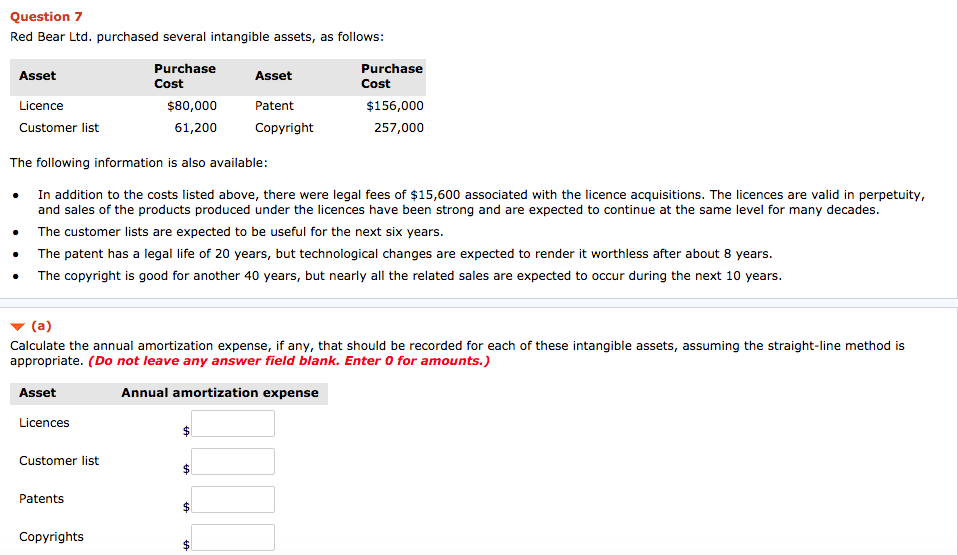

Question: Question 7 Red Bear Ltd. purchased several intangible assets, as follows Purchase Cost Purchase Cost Asset Licence Customer list $80,000 61,200 Asset Patent Copyright $156,000

Question 7 Red Bear Ltd. purchased several intangible assets, as follows Purchase Cost Purchase Cost Asset Licence Customer list $80,000 61,200 Asset Patent Copyright $156,000 257,000 The following information is also available: In addition to the costs listed above, there were legal fees of $15,600 associated with the licence acquisitions. The licences are valid in perpetuity, and sales of the products produced under the licences have been strong and are expected to continue at the same level for many decades . The customer lists are expected to be useful for the next six years The patent has a legal life of 20 years, but technological changes are expected to render it worthless after about 8 years . The copyright is good for another 40 years, but nearly all the related sales are expected to occur during the next 10 years (a) Calculate the annual amortization expense, if any, that should be recorded for each of these intangible assets, assuming the straight-line method is appropriate. (Do not leave any answer field blank. Enter 0 for amounts.) Asset Annual amortization expense Licences Customer list Patents Copyrights

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts