Question: Question 7 Study the scenario and complete the question that follows: Maksima Traders The bookkeeper of Maksima Traders prepared the Statement of Profit or Loss

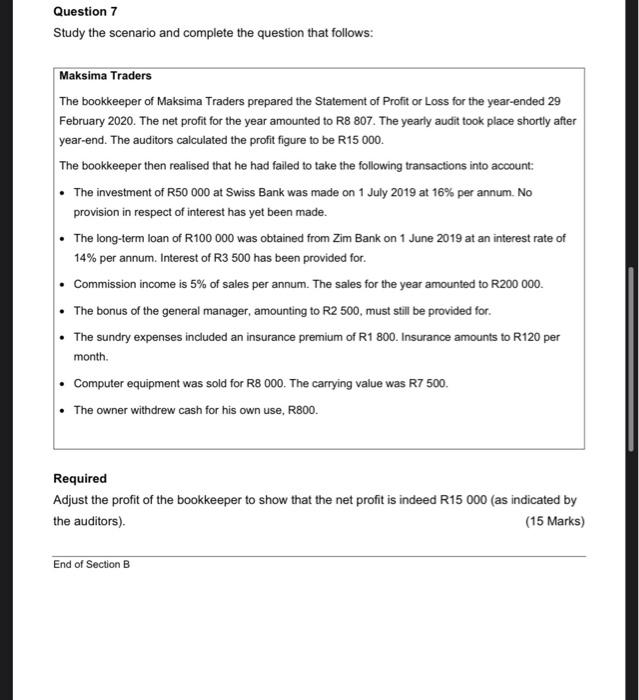

Question 7 Study the scenario and complete the question that follows: Maksima Traders The bookkeeper of Maksima Traders prepared the Statement of Profit or Loss for the year-ended 29 February 2020. The net profit for the year amounted to R8 807. The yearly audit took place shortly after year-end. The auditors calculated the profit figure to be R15 000 The bookkeeper then realised that he had failed to take the following transactions into account: The investment of R50 000 at Swiss Bank was made on 1 July 2019 at 16% per annum. No provision in respect of interest has yet been made. The long-term loan of R100 000 was obtained from Zim Bank on 1 June 2019 at an interest rate of 14% per annum. Interest of R3 500 has been provided for Commission income is 5% of sales per annum. The sales for the year amounted to R200 000 The bonus of the general manager, amounting to R2 500, must still be provided for. The sundry expenses included an insurance premium of R1 800. Insurance amounts to R120 per month. Computer equipment was sold for R8 000. The carrying value was R7 500 The owner withdrew cash for his own use, R800. Required Adjust the profit of the bookkeeper to show that the net profit is indeed R15 000 (as indicated by the auditors). (15 Marks) End of Section B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts