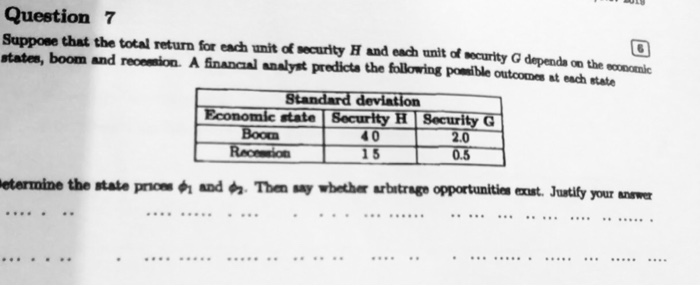

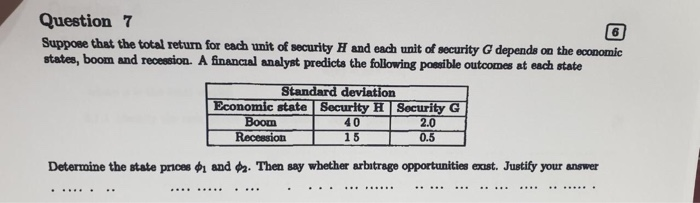

Question: Question 7 Suppose that the total return for each unit of curity and each unit of security G depends on these staten, boom and reosion.

Question 7 Suppose that the total return for each unit of curity and each unit of security G depends on these staten, boom and reosion. A financial Analyst predict the following pomible outcomes at each state Standard deviation onomic state Security Security G Boon 40 2.0 Rondon 15 015 etermine the state pron And The way whether arbitrage opportunities exist. Justify your new Question 7 Suppone that the total return for each unit of security H and each unit of security G depends on the economic stateo, boom and recension. A financial Analyst predicts the following ponsible outcomes at each state Standard deviation Economic state Security H Security G Boom 40 2.0 Recession 15 0.5 Determine the state prices 1 and . Then say whether arbitrage opportunities exist. Justify your answer ............. . ............ ......................... Question 7 Suppose that the total return for each unit of curity and each unit of security G depends on these staten, boom and reosion. A financial Analyst predict the following pomible outcomes at each state Standard deviation onomic state Security Security G Boon 40 2.0 Rondon 15 015 etermine the state pron And The way whether arbitrage opportunities exist. Justify your new Question 7 Suppone that the total return for each unit of security H and each unit of security G depends on the economic stateo, boom and recension. A financial Analyst predicts the following ponsible outcomes at each state Standard deviation Economic state Security H Security G Boom 40 2.0 Recession 15 0.5 Determine the state prices 1 and . Then say whether arbitrage opportunities exist. Justify your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts