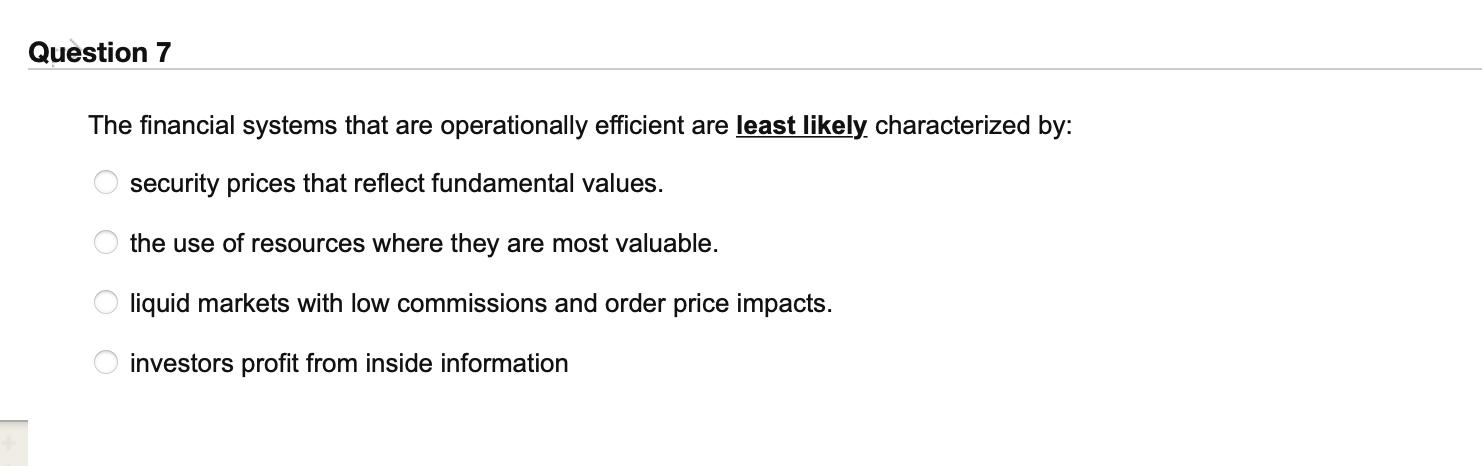

Question: Question 7 The financial systems that are operationally efficient are least likely characterized by: security prices that reflect fundamental values. OOOO the use of

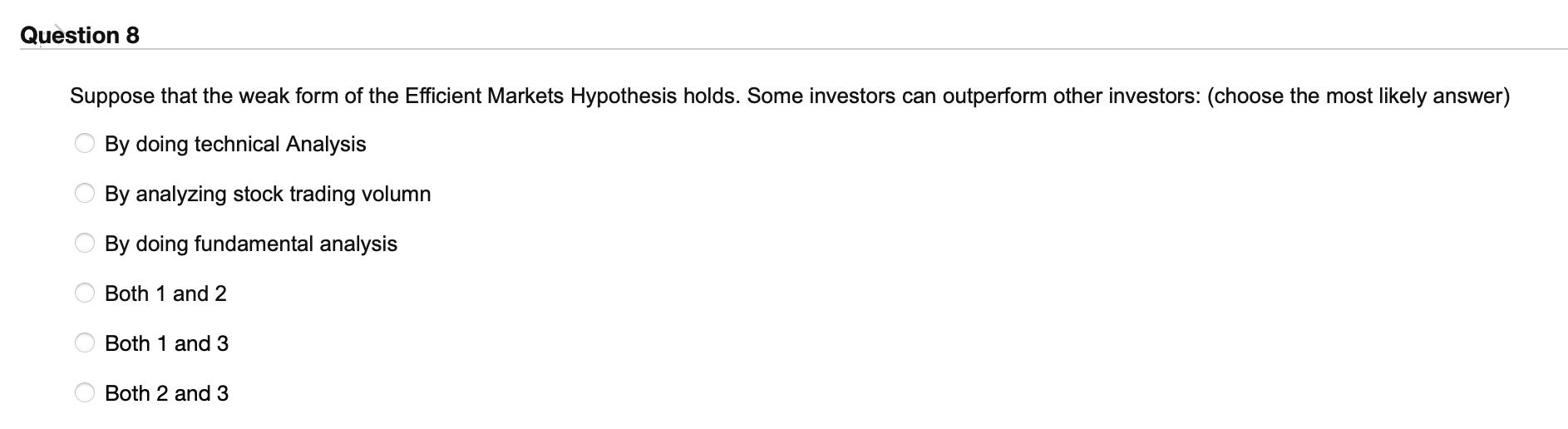

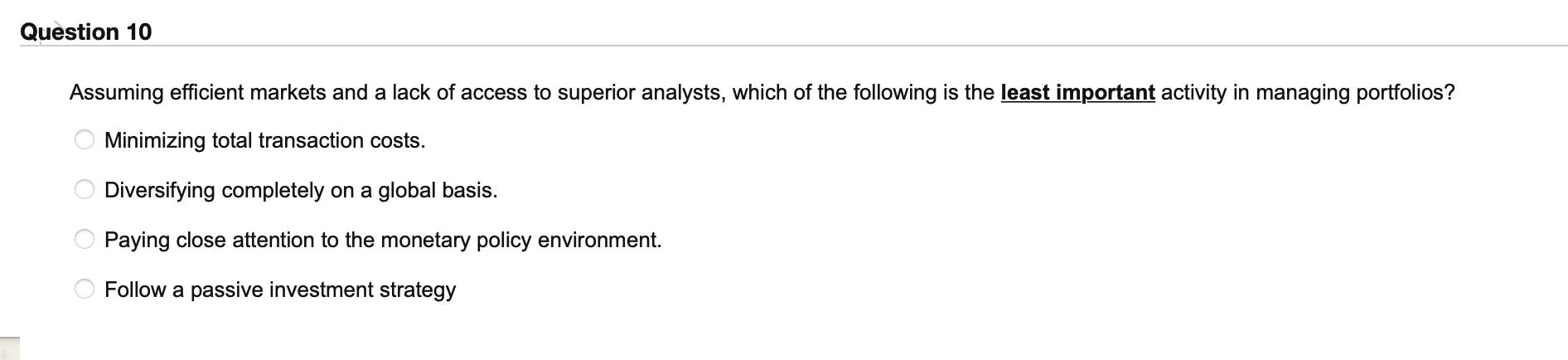

Question 7 The financial systems that are operationally efficient are least likely characterized by: security prices that reflect fundamental values. OOOO the use of resources where they are most valuable. liquid markets with low commissions and order price impacts. investors profit from inside information Question 8 Suppose that the weak form of the Efficient Markets Hypothesis holds. Some investors can outperform other investors: (choose the most likely answer) By doing technical Analysis By analyzing stock trading volumn By doing fundamental analysis Both 1 and 2 OO Both 1 and 3 Both 2 and 3 Question 10 Assuming efficient markets and a lack of access to superior analysts, which of the following is the least important activity in managing portfolios? Minimizing total transaction costs. Diversifying completely on a global basis. Paying close attention to the monetary policy environment. Follow a passive investment strategy

Step by Step Solution

3.41 Rating (157 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided below Question 7 The answer is investors prof... View full answer

Get step-by-step solutions from verified subject matter experts