Question: QUESTION 7 The net present value (NPV) method assumes that cash inflows from a project are reinvested at... athe WACC O b.0%. c. the risk-free

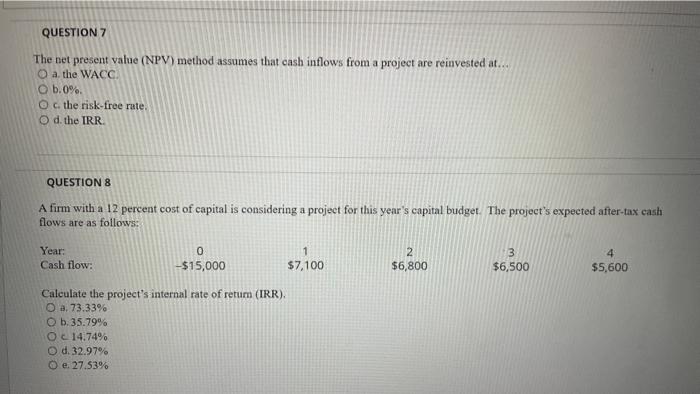

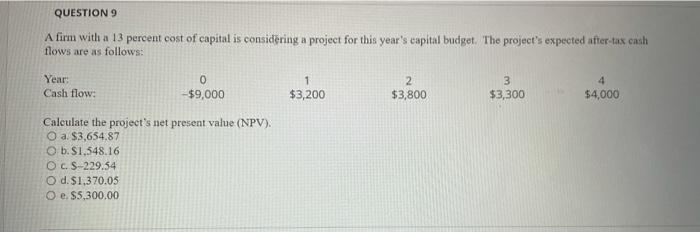

QUESTION 7 The net present value (NPV) method assumes that cash inflows from a project are reinvested at... athe WACC O b.0%. c. the risk-free rate. O d. the IRR QUESTION 8 A firm with a 12 percent cost of capital is considering a project for this year's capital budget. The project's expected after-tax cash flows are as follows: Year: Cash flow: 0 -$15,000 1 $7.100 2 $6,800 3 $6,500 4 $5,600 Calculate the project's internal rate of retum (IRR), O a. 73.33% O b.35.79% O c 14.74% d.32.97% O e 27.53% QUESTION 9 A firm with a 13 percent cost of capital is considering a project for this year's capital budget. The project's expected after-tax cash flows are as follows: Year: Cash flow: 0 -$9,000 1 $3,200 2 $3,800 3 $3,300 $4,000 Calculate the project's net present value (NPV). O a. $3,654.87 b. S1,548.16 O CS-229.54 O d. $1,370.05 O e. $5,300.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts