Question: Question 7 to Question 10 is based on this problem Saudi Arabian Oil Company (SAOC) is planning to make a bid for oil and gas

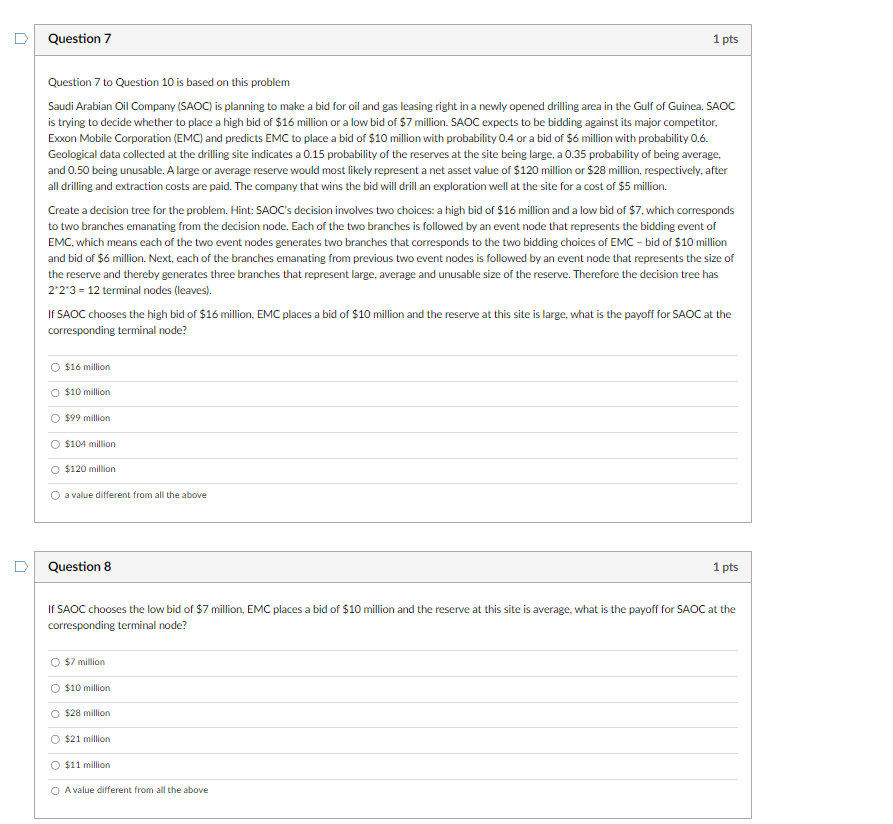

Question 7 to Question 10 is based on this problem Saudi Arabian Oil Company (SAOC) is planning to make a bid for oil and gas leasing right in a newly opened drilling area in the Gulf of Guinea. SAOC is trying to decide whether to place a high bid of $16 million or a low bid of $7 million. SAOC expects to be bidding against its major competitor, Exxon Mobile Corporation (EMC) and predicts EMC to place a bid of $10 million with probability 0.4 or a bid of $6 million with probability 0.6 . Geological data collected at the drilling site indicates a 0.15 probability of the reserves at the site being large, a 0.35 probability of being average, and 0.50 being unusable. A large or average reserve would most likely represent a net asset value of $120 million or $28 million, respectively, after all drilling and extraction costs are paid. The company that wins the bid will drill an exploration well at the site for a cost of $5 million. Create a decision tree for the problem. Hint: SAOC's decision involves two choices: a high bid of $16 million and a low bid of $7, which corresponds to two branches emanating from the decision node. Each of the two branches is followed by an event node that represents the bidding event of EMC, which means each of the two event nodes generates two branches that corresponds to the two bidding choices of EMC - bid of $10 million and bid of $6 million. Next, each of the branches emanating from previous two event nodes is followed by an event node that represents the size of the reserve and thereby generates three branches that represent large, average and unusable size of the reserve. Therefore the decision tree has 223=12 terminal nodes (leaves). If SAOC chooses the high bid of $16 million, EMC places a bid of $10 million and the reserve at this site is large, what is the payoff for SAOC at the corresponding terminal node? $16 million $10 million $99 million $104 million $120 million a value different from all the above Question 8 1 pts If SAOC chooses the low bid of $7 million, EMC places a bid of $10 million and the reserve at this site is average, what is the payoff for SAOC at the corresponding terminal node? $7 million $10 million $28 million $21 million $11 million A value different from all the above Question 9 1 pts What is the optimal decision according to the EMV criterion? A. SAOC chooses the high bid of $16 million. B. SAOC chooses the low bid of $7 million. c. SAOC does not make a bid. Question 10 1 pts Assume that the company that wins the bid will drill an exploration well at the site for a cost of $12 million rather than $5 million, what is the optimal decision according to the EMV criterion? A. SAOC chooses the high bid of $16 million. B. SAOC chooses the low bid of $7 million. c. SAOC does not make a bid

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts