Question: Question 7 (Value at Risk) (6 marks) Consider a portfolio consisting of $10 million invested in the S&P 500 and $2.5 million invested in U.S.

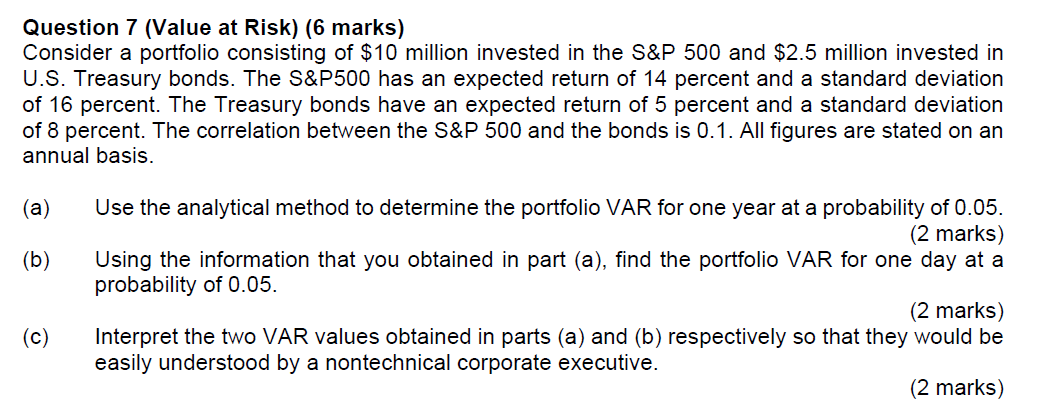

Question 7 (Value at Risk) (6 marks) Consider a portfolio consisting of $10 million invested in the S&P 500 and $2.5 million invested in U.S. Treasury bonds. The S&P500 has an expected return of 14 percent and a standard deviation of 16 percent. The Treasury bonds have an expected return of 5 percent and a standard deviation of 8 percent. The correlation between the S&P 500 and the bonds is 0.1. All figures are stated on an annual basis. (a) (b) Use the analytical method to determine the portfolio VAR for one year at a probability of 0.05. (2 marks) Using the information that you obtained in part (a), find the portfolio VAR for one day at a probability of 0.05. (2 marks) Interpret the two VAR values obtained in parts (a) and (b) respectively so that they would be easily understood by a nontechnical corporate executive. (2 marks) (C) Question 7 (Value at Risk) (6 marks) Consider a portfolio consisting of $10 million invested in the S&P 500 and $2.5 million invested in U.S. Treasury bonds. The S&P500 has an expected return of 14 percent and a standard deviation of 16 percent. The Treasury bonds have an expected return of 5 percent and a standard deviation of 8 percent. The correlation between the S&P 500 and the bonds is 0.1. All figures are stated on an annual basis. (a) (b) Use the analytical method to determine the portfolio VAR for one year at a probability of 0.05. (2 marks) Using the information that you obtained in part (a), find the portfolio VAR for one day at a probability of 0.05. (2 marks) Interpret the two VAR values obtained in parts (a) and (b) respectively so that they would be easily understood by a nontechnical corporate executive. (2 marks) (C)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts