Question: QUESTION 7 Water's Edge Resorts is evaluating a project that would require an initial investment in equipment of $ 4 9 0 , 0 0

QUESTION

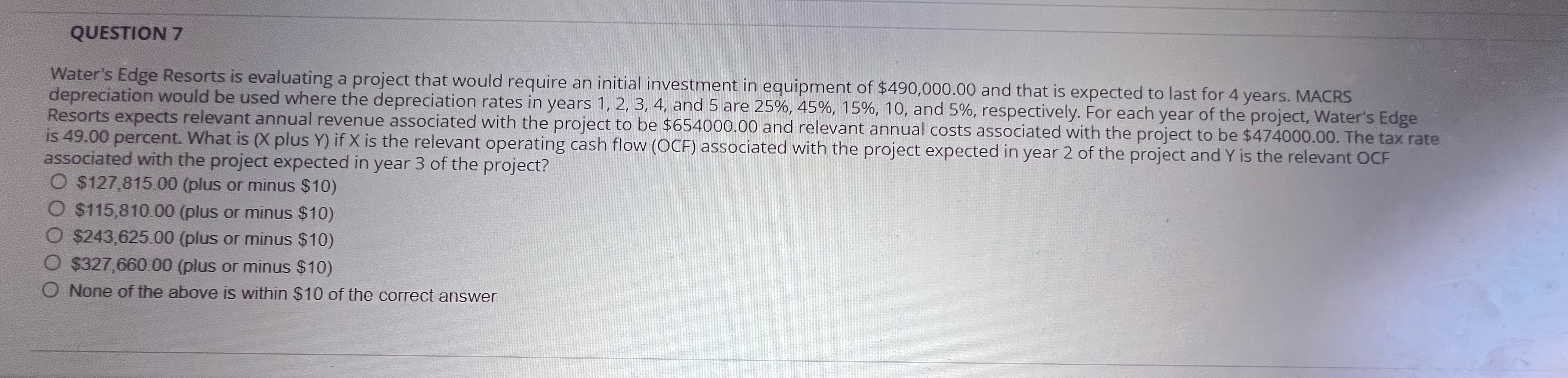

Water's Edge Resorts is evaluating a project that would require an initial investment in equipment of $ and that is expected to last for years. MACRS depreciation would be used where the depreciation rates in years and are and respectively. For each year of the project, Water's Edge Resorts expects relevant annual revenue associated with the project to be $ and relevant annual costs associated with the project to be $ The tax rate is percent. What is plus if is the relevant operating cash flow OCF associated with the project expected in year of the project and is the relevant OCF associated with the project expected in year of the project?

$plus or minus $

$plus or minus $

$plus or minus $

$plus or minus $

None of the above is within $ of the correct answer

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock