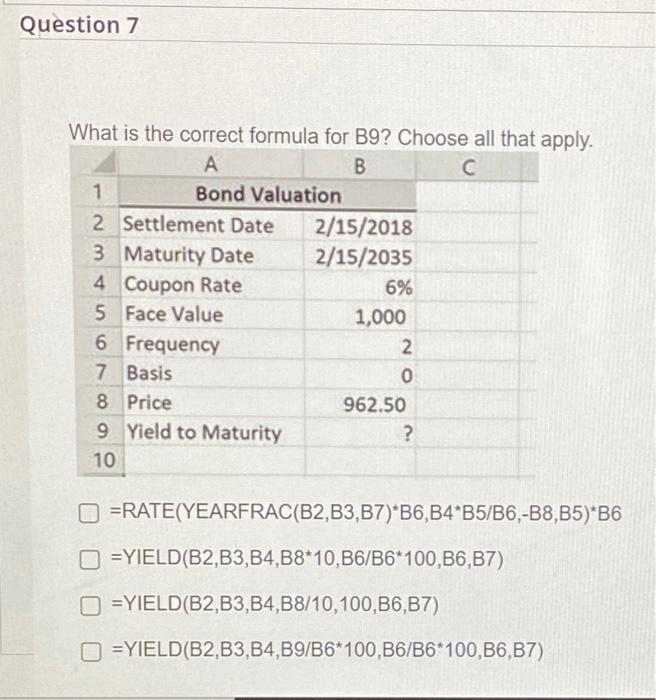

Question: Question 7 What is the correct formula for B9? Choose all that apply. A B C Bond Valuation 1 2 Settlement Date 3 Maturity Date

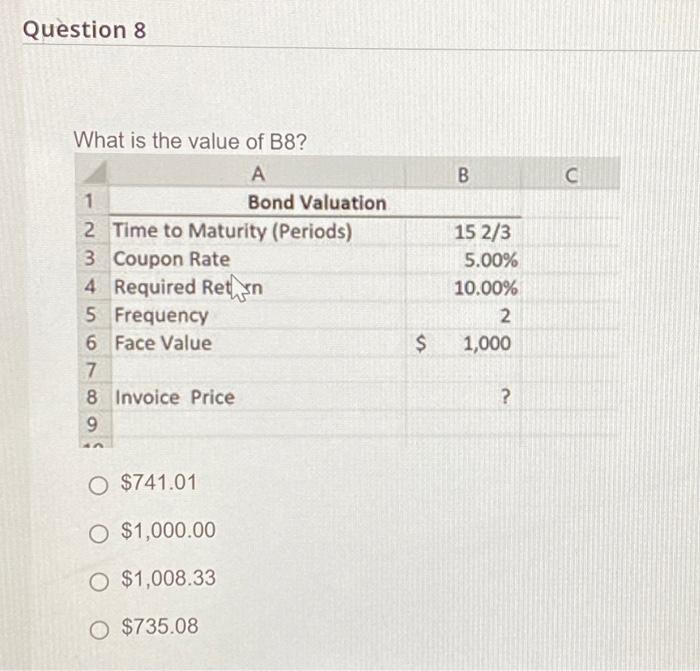

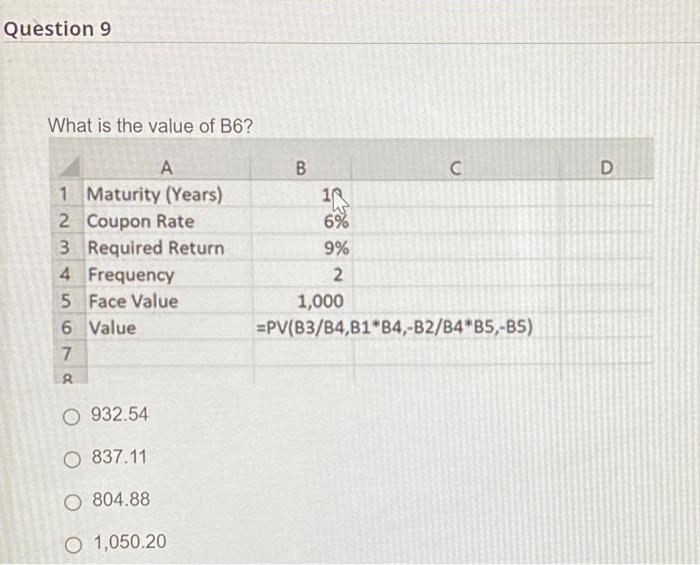

Question 7 What is the correct formula for B9? Choose all that apply. A B C Bond Valuation 1 2 Settlement Date 3 Maturity Date 4 Coupon Rate 5 Face Value 6 Frequency 7 Basis 8 Price 9 Yield to Maturity 10 2/15/2018 2/15/2035 6% 1,000 2 0 962.50 ? =RATE(YEARFRAC(B2,B3,B7) *B6,B4*B5/B6,-B8,B5)*B6 =YIELD(B2,B3,B4,B8*10, B6/B6*100,B6,B7) O=YIELD(B2,B3,B4,B8/10,100,B6,B7) =YIELD(B2,B3,B4,B9/B6*100,B6/B6*100,B6,B7) Question 8 What is the value of B8? A Bond Valuation 1 2 Time to Maturity (Periods) 3 Coupon Rate 4 Required Retn 5 Frequency 6 Face Value 7 8 Invoice Price 9 47 O $741.01 O $1,000.00 O $1,008.33 O $735.08 $ B 15 2/3 5.00% 10.00% 2 1,000 ? C Question 9 What is the value of B6? A 1 Maturity (Years) 2 Coupon Rate 3 Required Return 4 Frequency 5 Face Value 6 Value 7 R O932.54 O 837.11 O804.88 O 1,050.20 B 1 6% 9% 2 C 1,000 =PV(B3/B4,B1 B4,-B2/B4*B5,-B5) D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts