Question: QUESTION 7 XYZ is considering a project that would last for 3 years and have a cost of capital of 21.0 percent. The relevant level

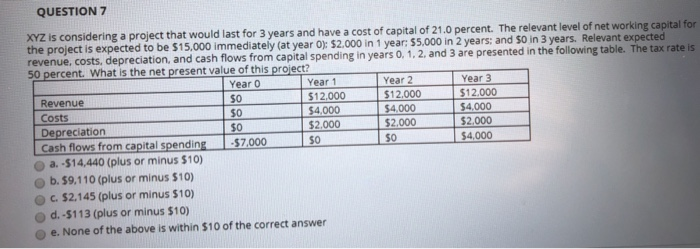

QUESTION 7 XYZ is considering a project that would last for 3 years and have a cost of capital of 21.0 percent. The relevant level of net working capital for the project is expected to be $15,000 immediately (at year O): 52.000 in 1 year: 55.000 in 2 years and 50 in 3 years. Relevant expected revenue, costs, depreciation, and cash flows from capital spending in years . 1. 2. and 3 are presented in the following table. The tax rate is 50 percent. What is the net present value of this project? Year o Year 1 Year 2 Year 3 Revenue SO $12.000 $12.000 $12.000 Costs S 5 0 $4,000 $4.000 $4.000 Depreciation $0 $2.000 $2,000 $2.000 Cash flows from capital spending -57,000 50 SO $4,000 a. -514,440 (plus or minus 510) b. 59.110 (plus or minus 510) c. $2,145 (plus or minus 510) d. -5113 (plus or minus $10) e. None of the above is within $10 of the correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts