Question: Question 70 Why do we expense depreciation over a number of years rather than just expense an asset when it is purchased? We are trying

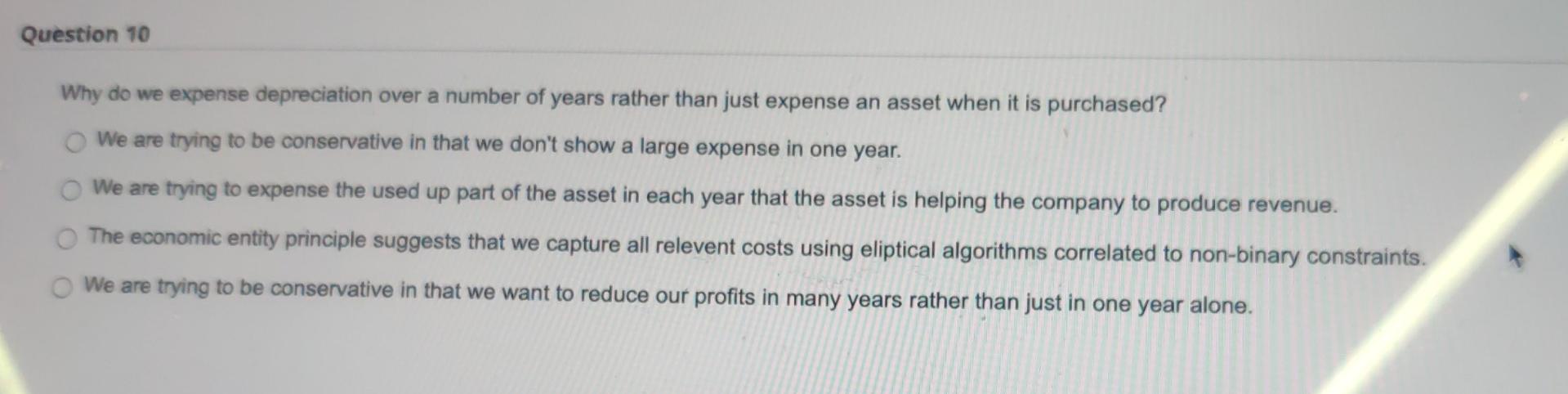

Question 70 Why do we expense depreciation over a number of years rather than just expense an asset when it is purchased? We are trying to be conservative in that we don't show a large expense in one year. We are trying to expense the used up part of the asset in each year that the asset is helping the company to produce revenue. The economic entity principle suggests that we capture all relevent costs using eliptical algorithms correlated to non-binary constraints. We are trying to be conservative in that we want to reduce our profits in many years rather than just in one year alone

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts