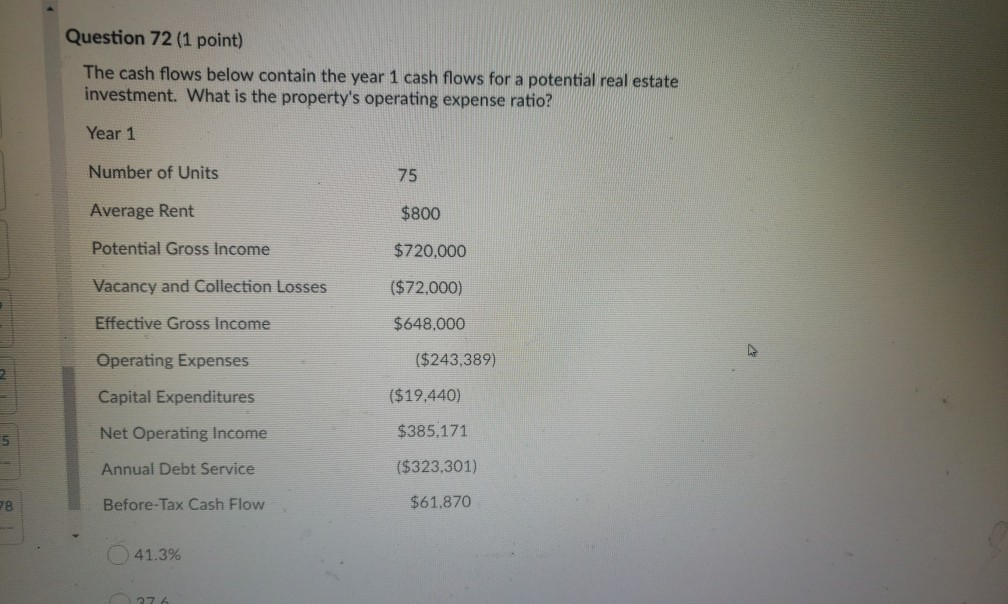

Question: Question 72 (1 point) The cash flows below contain the year 1 cash flows for a potential real estate investment. What is the property's operating

Question 72 (1 point) The cash flows below contain the year 1 cash flows for a potential real estate investment. What is the property's operating expense ratio? Year 1 Number of Units 75 Average Rent $800 Potential Gross Income $720,000 Vacancy and Collection Losses ($72,000) Effective Gross Income $648,000 Operating Expenses ($243,389) ($19,440) Capital Expenditures $385.171 Net Operating Income 5n ($323,301) Annual Debt Service $61,870 Before-Tax Cash Flow 82 41.3% Question 72 (1 point) The cash flows below contain the year 1 cash flows for a potential real estate investment. What is the property's operating expense ratio? Year 1 Number of Units 75 Average Rent $800 Potential Gross Income $720,000 Vacancy and Collection Losses ($72,000) Effective Gross Income $648,000 Operating Expenses ($243,389) ($19,440) Capital Expenditures $385.171 Net Operating Income 5n ($323,301) Annual Debt Service $61,870 Before-Tax Cash Flow 82 41.3%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts