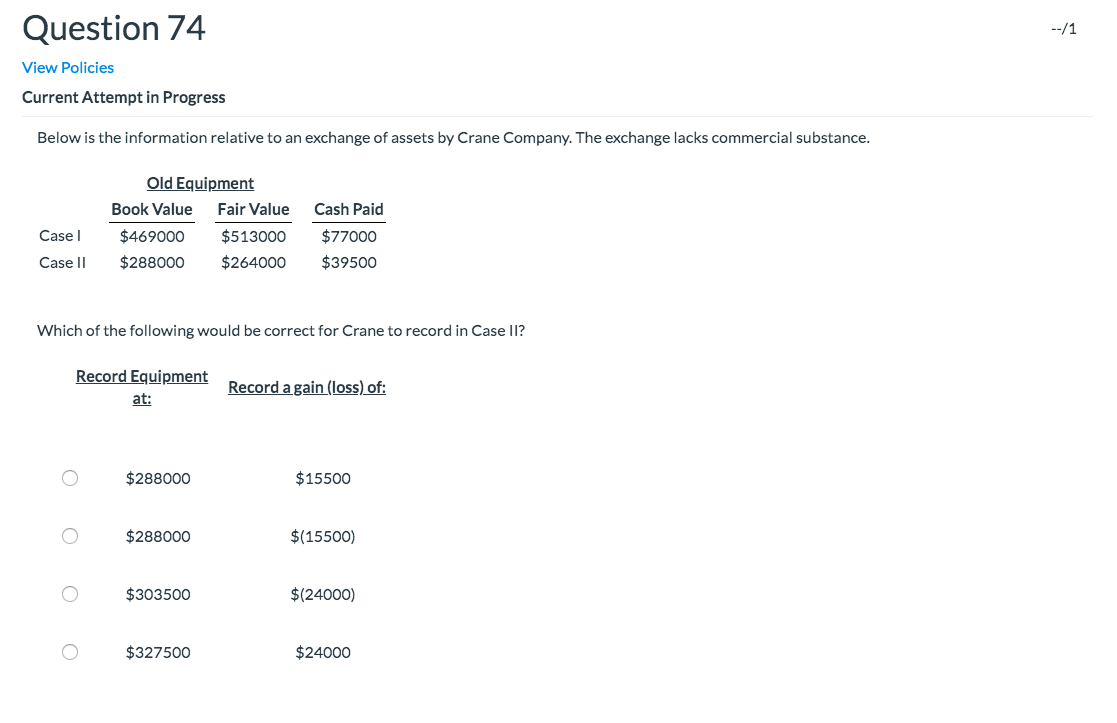

Question: Question 74 --/1 View Policies Current Attempt in Progress Below is the information relative to an exchange of assets by Crane Company. The exchange lacks

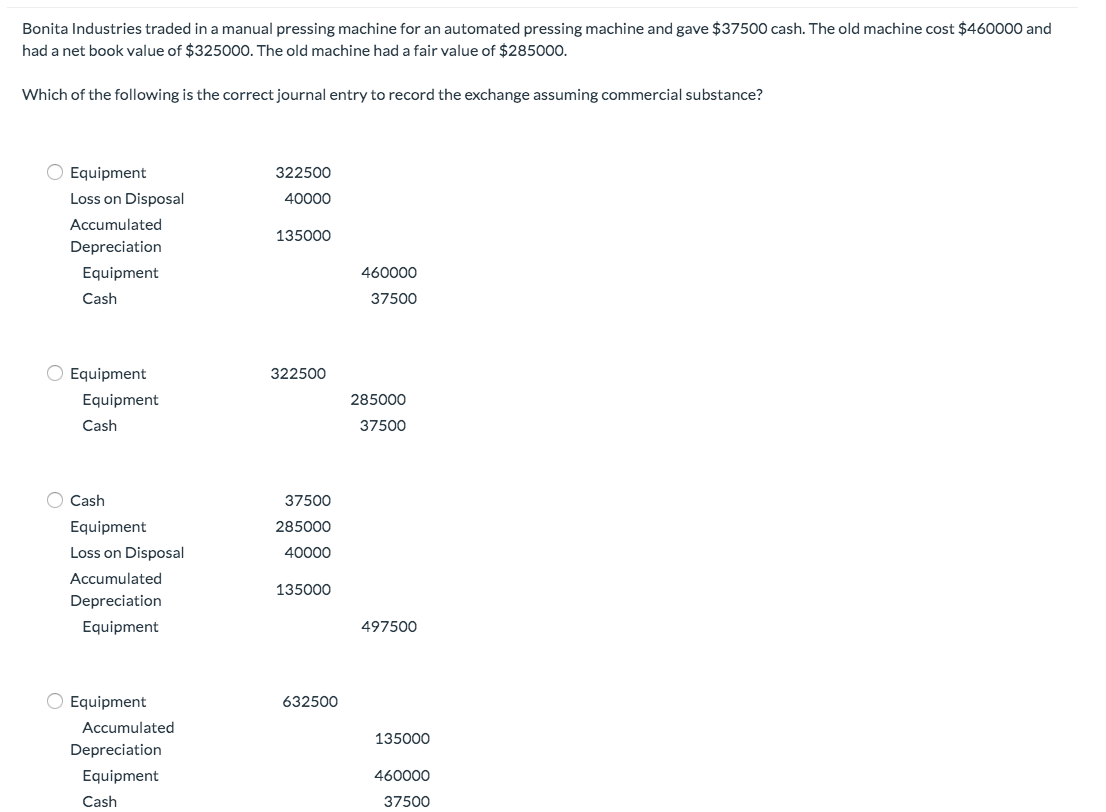

Question 74 --/1 View Policies Current Attempt in Progress Below is the information relative to an exchange of assets by Crane Company. The exchange lacks commercial substance. Old Equipment Book Value Fair Value Case 1 Case 11 $469000 $288000 $513000 $264000 Cash Paid $77000 $39500 Which of the following would be correct for Crane to record in Case II? Record Equipment at: Record again (loss) of: $288000 $15500 $288000 $(15500) O $303500 $(24000) $327500 $24000 Bonita Industries traded in a manual pressing machine for an automated pressing machine and gave $37500 cash. The old machine cost $460000 and had a net book value of $325000. The old machine had a fair value of $285000. Which of the following is the correct journal entry to record the exchange assuming commercial substance? 322500 40000 O Equipment Loss on Disposal Accumulated Depreciation Equipment Cash 135000 460000 37500 322500 Equipment Equipment Cash 285000 37500 37500 285000 40000 Cash Equipment Loss on Disposal Accumulated Depreciation Equipment 135000 497500 632500 135000 Equipment Accumulated Depreciation Equipment Cash 460000 37500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts