Question: Question 8 0/1 point If the correlation between the returns of two stocks are less than one, the standard deviation of the portfolio formed using

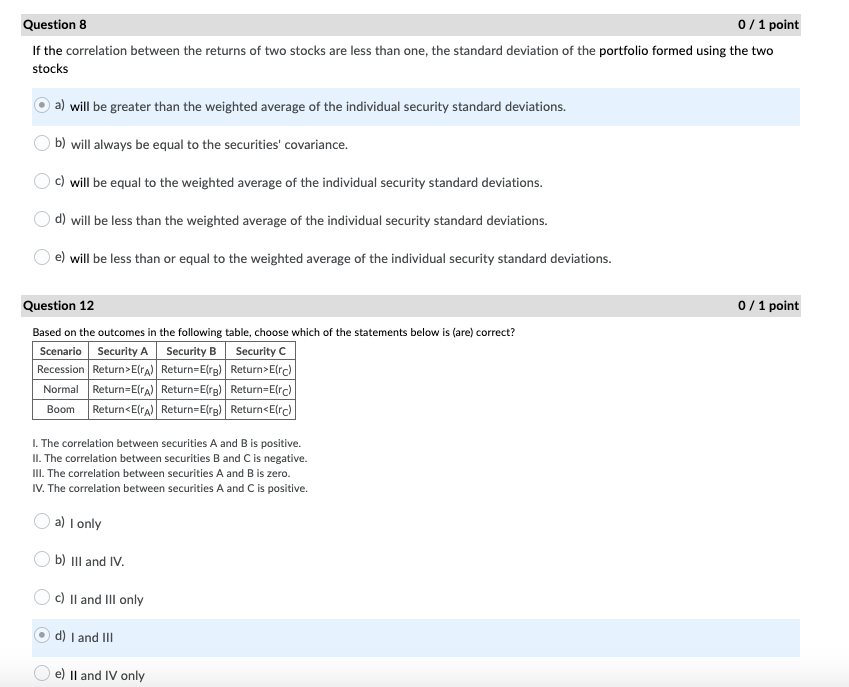

Question 8 0/1 point If the correlation between the returns of two stocks are less than one, the standard deviation of the portfolio formed using the two stocks a) will be greater than the weighted average of the individual security standard deviations. b) will always be equal to the securities' covariance. c) will be equal to the weighted average of the individual security standard deviations. 0 d) will be less than the weighted average of the individual security standard deviations. e) will be less than or equal to the weighted average of the individual security standard deviations. 0/1 point Question 12 Based on the outcomes in the following table, choose which of the statements below is (are) correct? Scenario Security A Security B Security C Recession Return>E(PA) Return=E(re) Return>E(rc) Normal Return=E(A) Return=E(r) Return=E(rc) Boom Return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts