Question: Question 8 0.5 points Save Answer Assume that you are thinking about starting your own small business. The equipment costs incurred to start the business

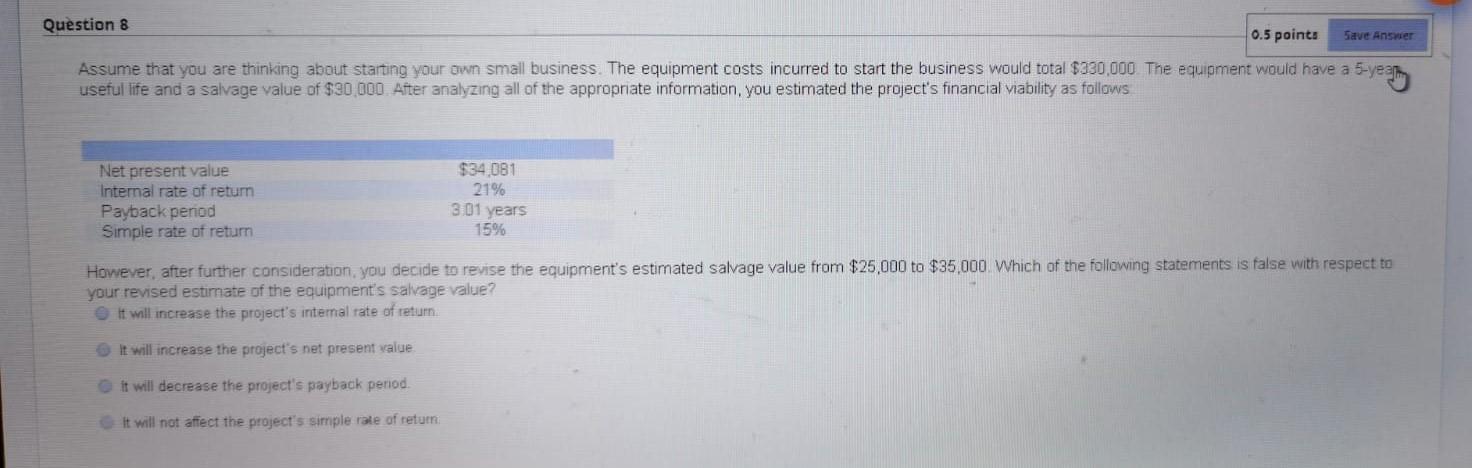

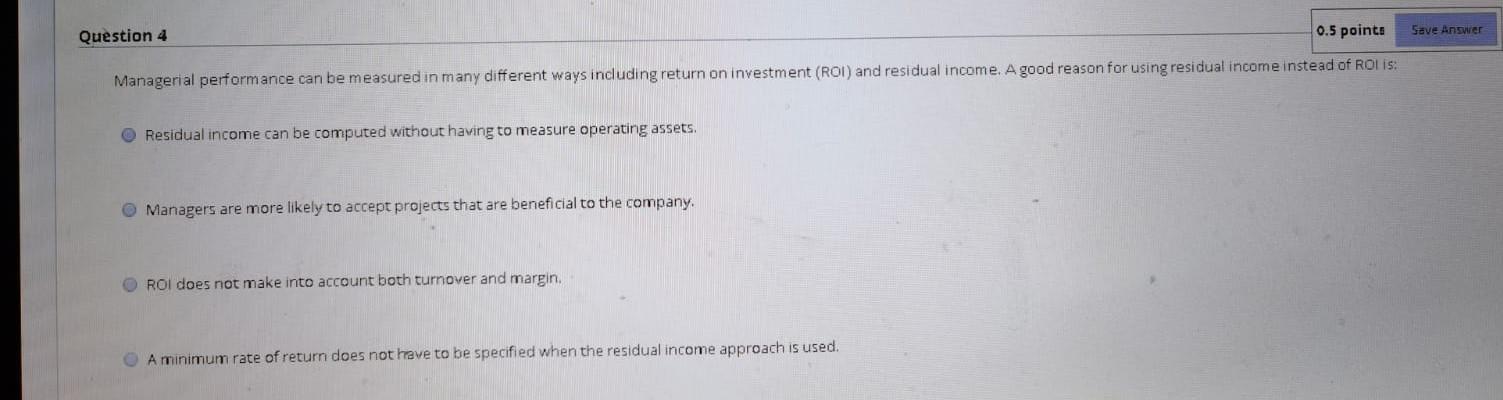

Question 8 0.5 points Save Answer Assume that you are thinking about starting your own small business. The equipment costs incurred to start the business would total $330.000 The equipment would have a 5-year useful life and a salvage value of $90,000 After analyzing all of the appropriate information, you estimated the project's financial viability as follows Net present value Internal rate of return Payback penod Simple rate of return $34 081 21% 3.01 years 15% However, after further consideration, you decide to revise the equipment's estimated salvage value from $25,000 to $35,000 Which of the following statements is false with respect to your revised estimate of the equipment's salvage value? It will increase the project's internal rate of return It will increase the project's net present value it will decrease the project's payback period It will not affect the project's simple rate of retum 0.5 points Question 4 Save Answer Managerial performance can be measured in many different ways including return on investment (ROI) and residual income. A good reason for using residual income instead of ROI is: Residual income can be computed without having to measure operating assets. Managers are more likely to accept projects that are beneficial to the company. ROI does not make into account both turnover and margin. A minimum rate of return does not have to be specified when the residual income approach is used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts