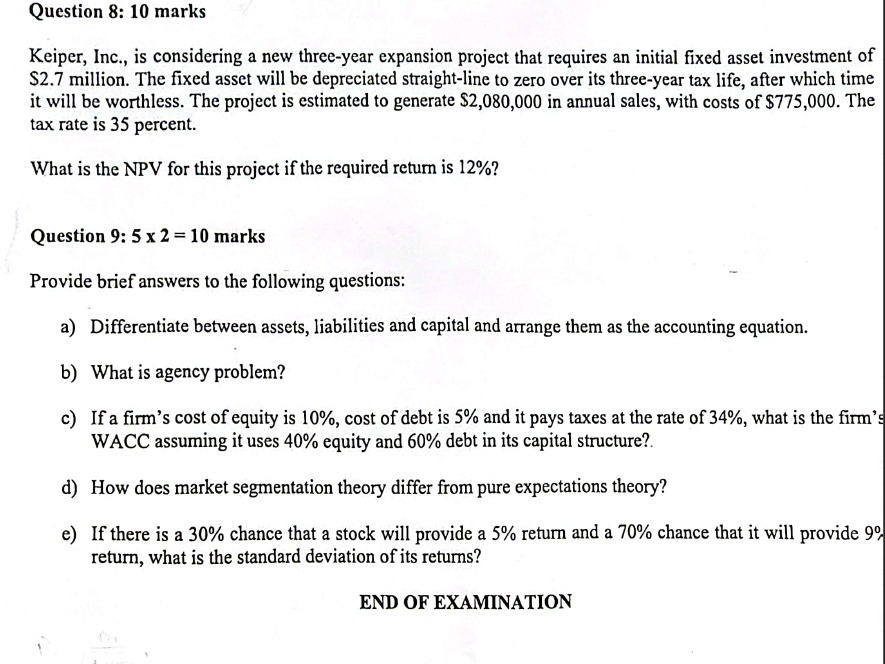

Question: Question 8 : 1 0 marks Keiper, Inc., is considering a new three - year expansion project that requires an initial fixed asset investment of

Question : marks Keiper, Inc., is considering a new threeyear expansion project that requires an initial fixed asset investment of $ million. The fixed asset will be depreciated straightline to zero over its threeyear tax life, after which time it will be worthless. The project is estimated to generate $ in annual sales, with costs of $ The tax rate is percent. What is the NPV for this project if the required return is Question : times marks Provide brief answers to the following questions: a Differentiate between assets, liabilities and capital and arrange them as the accounting equation. b What is agency problem? c If a firm's cost of equity is cost of debt is and it pays taxes at the rate of what is the firm's WACC assuming it uses equity and debt in its capital structure? d How does market segmentation theory differ from pure expectations theory? e If there is a chance that a stock will provide a return and a chance that it will provide return, what is the standard deviation of its returns? END OF EXAMINATION

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock