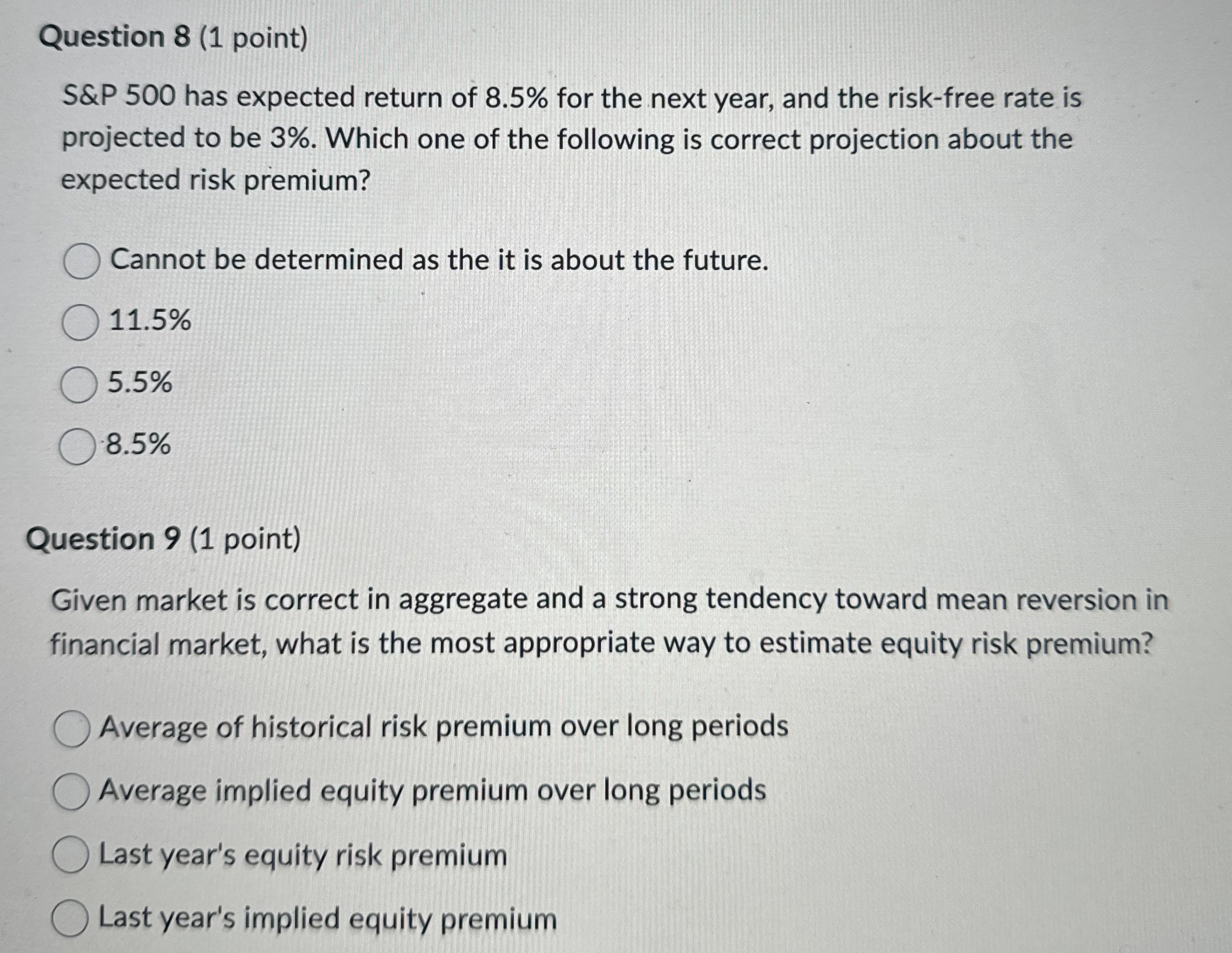

Question: Question 8 ( 1 point ) S&P 5 0 0 has expected return of 8 . 5 % for the next year, and the risk

Question point

S&P has expected return of for the next year, and the riskfree rate is

projected to be Which one of the following is correct projection about the

expected risk premium?

Cannot be determined as the it is about the future.

Question point

Given market is correct in aggregate and a strong tendency toward mean reversion in

financial market, what is the most appropriate way to estimate equity risk premium?

Average of historical risk premium over long periods

Average implied equity premium over long periods

Last year's equity risk premium

Last year's implied equity premium

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock