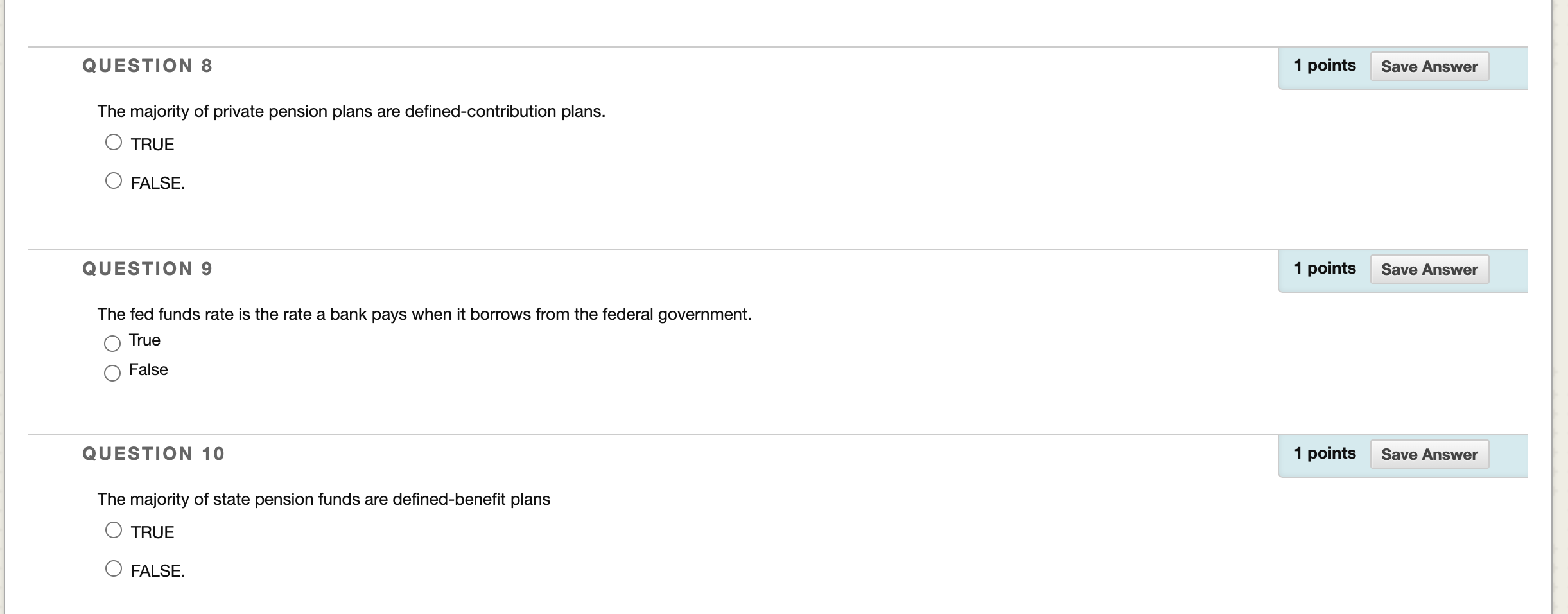

Question: QUESTION 8 1 points Save Answer The majority of private pension plans are defined-contribution plans. TRUE FALSE. QUESTION 9 1 points Save Answer The fed

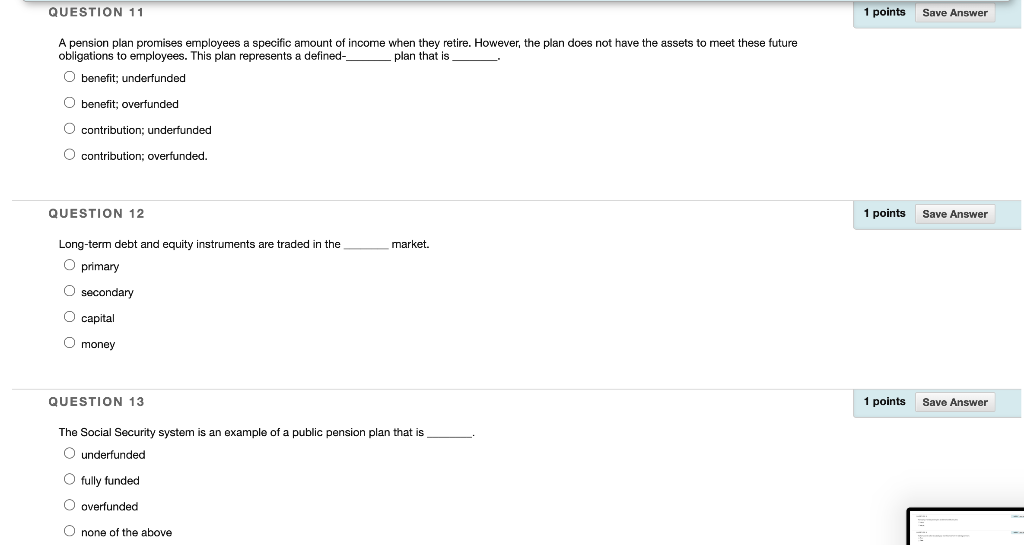

QUESTION 8 1 points Save Answer The majority of private pension plans are defined-contribution plans. TRUE FALSE. QUESTION 9 1 points Save Answer The fed funds rate is the rate a bank pays when it borrows from the federal government. True False QUESTION 10 1 points Save Answer The majority of state pension funds are defined-benefit plans TRUE FALSE. QUESTION 11 1 points Save Answer A pension plan promises employees a specific amount of income when they retire. However, the plan does not have the assets to meet these future obligations to employees. This plan represents a defined plan that is benefit; underfunded O benefit; overfunded O contribution: underfunded O contribution; overfunded. QUESTION 12 1 points Save Answer Long-term debt and equity instruments are traded in the market. O primary O secondary O capital O money QUESTION 13 1 points Save Answer The Social Security system is an example of a public pension plan that is O underfunded O fully funded O overfunded O none of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts