Question: Question 8 1 pts A company is considering installing a new molding machine which is expected to produce operating cash flows of $73,000 a year

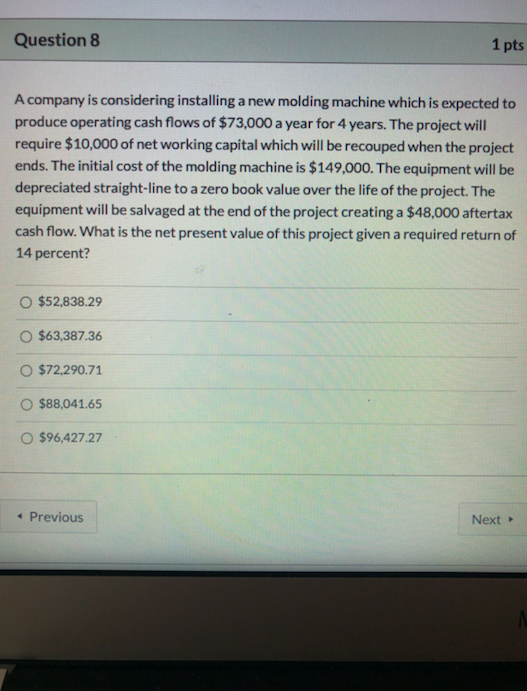

Question 8 1 pts A company is considering installing a new molding machine which is expected to produce operating cash flows of $73,000 a year for 4 years. The project will require $10,000 of net working capital which will be recouped when the project ends. The initial cost of the molding machine is $149,000. The equipment will be depreciated straight-line to a zero book value over the life of the project. The equipment will be salvaged at the end of the project creating a $48,000 aftertax cash flow. What is the net present value of this project given a required return of 14 percent? $52,838.29 O $63,387.36 O $72,290.71 O $88,041.65 O $96,427.27 - Previous Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts