Question: Question 8 (10 marks) Acme Co is considering buying a retail store from another company for $5,000,000. In year 1, Acme expects to generate $5,000,000

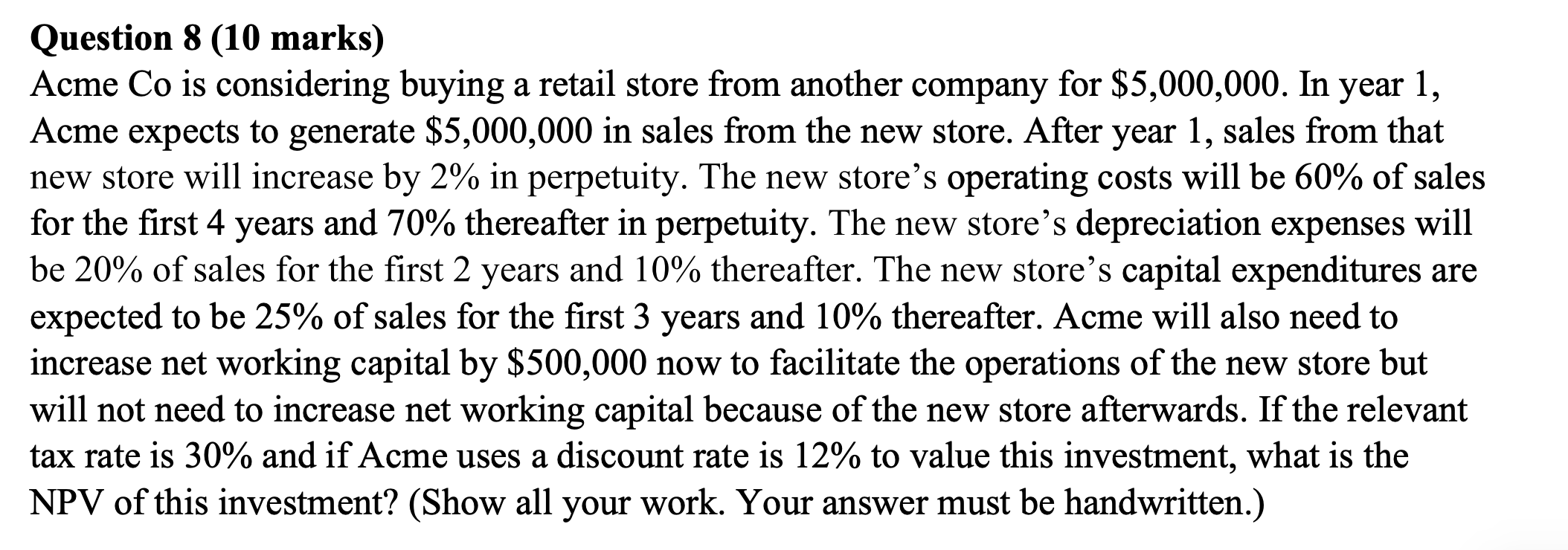

Question 8 (10 marks) Acme Co is considering buying a retail store from another company for $5,000,000. In year 1, Acme expects to generate $5,000,000 in sales from the new store. After year 1, sales from that new store will increase by 2% in perpetuity. The new store's operating costs will be 60% of sales for the first 4 years and 70% thereafter in perpetuity. The new stores depreciation expenses will be 20% of sales for the first 2 years and 10% thereafter. The new store's capital expenditures are expected to be 25% of sales for the first 3 years and 10% thereafter. Acme will also need to increase net working capital by $500,000 now to facilitate the operations of the new store but will not need to increase net working capital because of the new store afterwards. If the relevant tax rate is 30% and if Acme uses a discount rate is 12% to value this investment, what is the NPV of this investment? (Show all your work. Your answer must be handwritten.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts