Question: Question 8 (12 marks) DEF Ltd is considering whether it should invest in Project Y. To invest in this project, a machine is required to

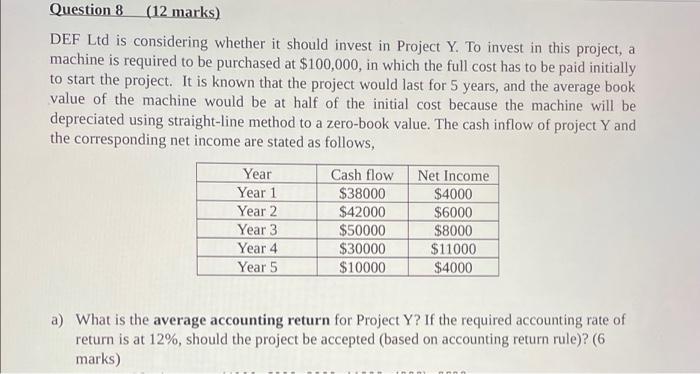

Question 8 (12 marks) DEF Ltd is considering whether it should invest in Project Y. To invest in this project, a machine is required to be purchased at $100,000, in which the full cost has to be paid initially to start the project. It is known that the project would last for 5 years, and the average book value of the machine would be at half of the initial cost because the machine will be depreciated using straight-line method to a zero-book value. The cash inflow of project Y and the corresponding net income are stated as follows, Year Year 1 Year 2 Year 3 Year 4 Year 5 Cash flow $38000 $42000 $50000 $30000 $10000 Net Income $4000 $6000 $8000 $11000 $4000 a) What is the average accounting return for Project Y? If the required accounting rate of return is at 12%, should the project be accepted (based on accounting return rule)? (6 marks) b) If the required return rate is at 11%, what is the profitability index for Project Y? Should the firm accept project Y based on the profitability index rule? (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts