Question: Question 8 (12.5 points) The table below gives the price of a six-month put option today, as well as the different Greek letters associated with

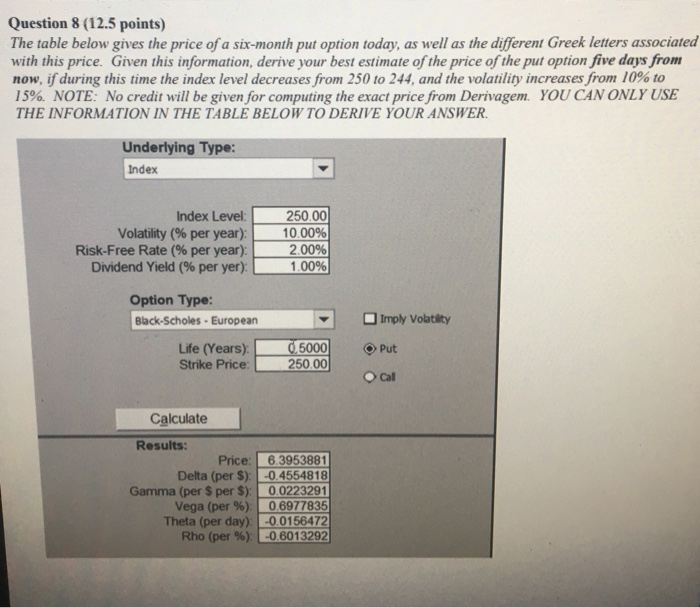

Question 8 (12.5 points) The table below gives the price of a six-month put option today, as well as the different Greek letters associated with this price. Given this information, derive your best estimate of the price of the put option five days from now, if during this time the index level decreases from 250 to 244, and the volatility increases from 10% to 15%. NOTE: No credit will be given for computing the exact price from Derivagem. YOU CAN ONLY USE THE INFORMATION IN THE TABLE BELOW TO DERIVE YOUR ANSWER. Underlying Type: Index Index Level: Volatility (% per year): Risk-Free Rate (% per year): Dividend Yield (% per yer): 250.00 10.00% 2.00% 1.00% Option Type: Black-Scholes - European Imply Volatility Life (Years): Strike Price: 0.5000 250.00 Put cal Calculate Results: Price: 6.3953881 Delta (per S): -0.4554818 Gamma (per $ per S): 0.0223291 Vega (per %): 0.6977835 Theta (per day): -0.0156472 Rho (per %): -0.6013292

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts