Question: Question 8 (2 points) Saved (Hard) (Numbers have been changed.) Assume that today is December 31, 2015, and that the following information applies to Vermeil

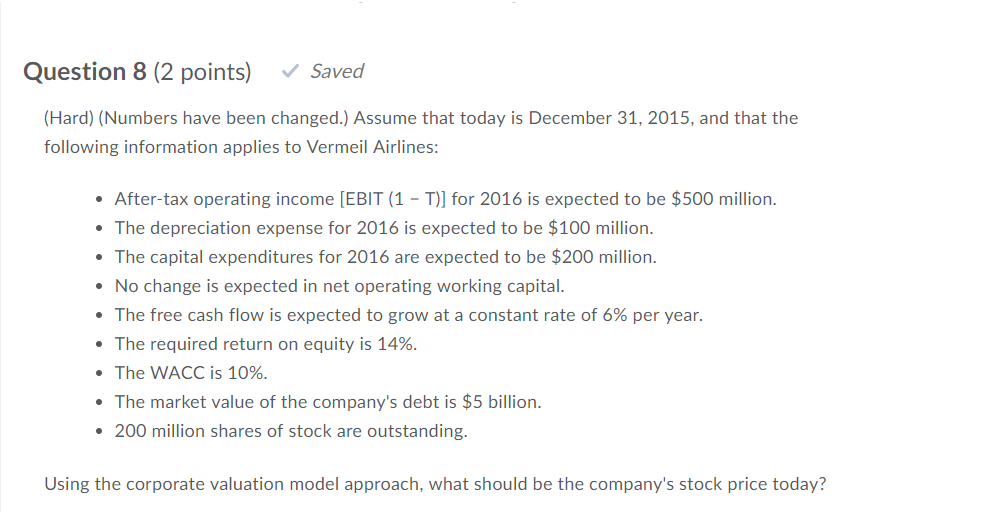

Question 8 (2 points) Saved (Hard) (Numbers have been changed.) Assume that today is December 31, 2015, and that the following information applies to Vermeil Airlines: After-tax operating income (EBIT (1 - T)] for 2016 is expected to be $500 million. The depreciation expense for 2016 is expected to be $100 million. The capital expenditures for 2016 are expected to be $200 million. No change is expected in net operating working capital. The free cash flow is expected to grow at a constant rate of 6% per year. The required return on equity is 14%. The WACC is 10%. The market value of the company's debt is $5 billion. 200 million shares of stock are outstanding. Using the corporate valuation model approach, what should be the company's stock price today

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts