Question: Question 8 (2 points) Suppose that you enter into a 6-month forward contract on a non-dividend paying stock when the stock price is $30 and

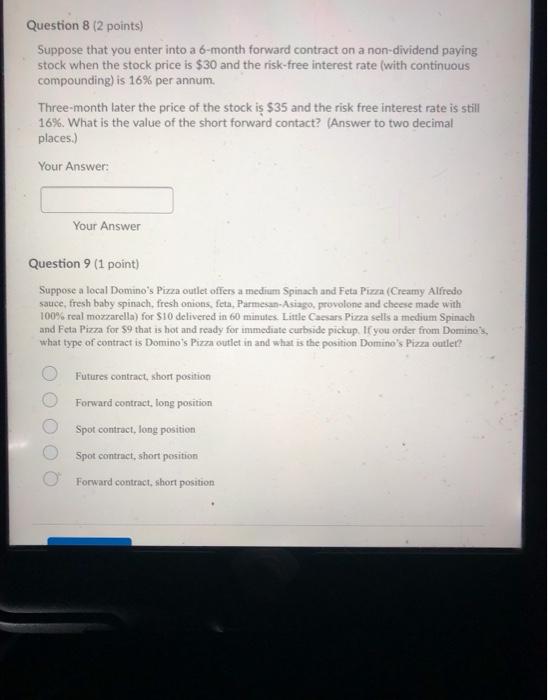

Question 8 (2 points) Suppose that you enter into a 6-month forward contract on a non-dividend paying stock when the stock price is $30 and the risk-free interest rate (with continuous compounding) is 16% per annum. Three-month later the price of the stock is $35 and the risk free interest rate is still 16%. What is the value of the short forward contact? (Answer to two decimal places.) Your Answer: Your Answer Question 9 (1 point) Suppose a local Domino's Pizza outlet offers a medium Spinach and Feta Pizza (Creamy Alfredo sauce, fresh baby spinach, fresh onions, feta, Parmesan Asiago, provolone and cheese made with 100% real mozzarella) for S10 delivered in 60 minutes Little Caesars Pizza sells a medium Spinach and Feta Pizza for 59 that is hot and ready for immediate curbside pickup. If you order from Domino's what type of contract is Domino's Pizza outlet in and what is the position Domino's Pizza outlet Futures contract, short position Forward contract, long position Spot contract, long position Spot contract, short position Forward contract, short position

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts