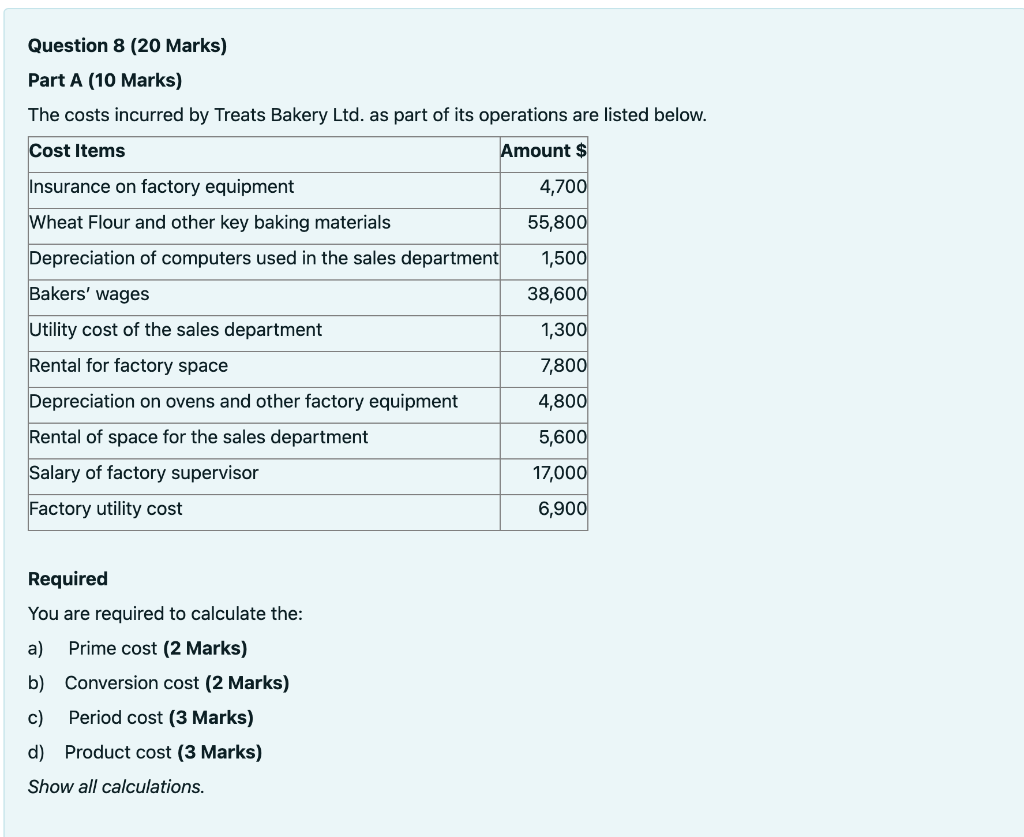

Question: Question 8 (20 Marks) Part A (10 Marks) The costs incurred by Treats Bakery Ltd. as part of its operations are listed below. Cost Items

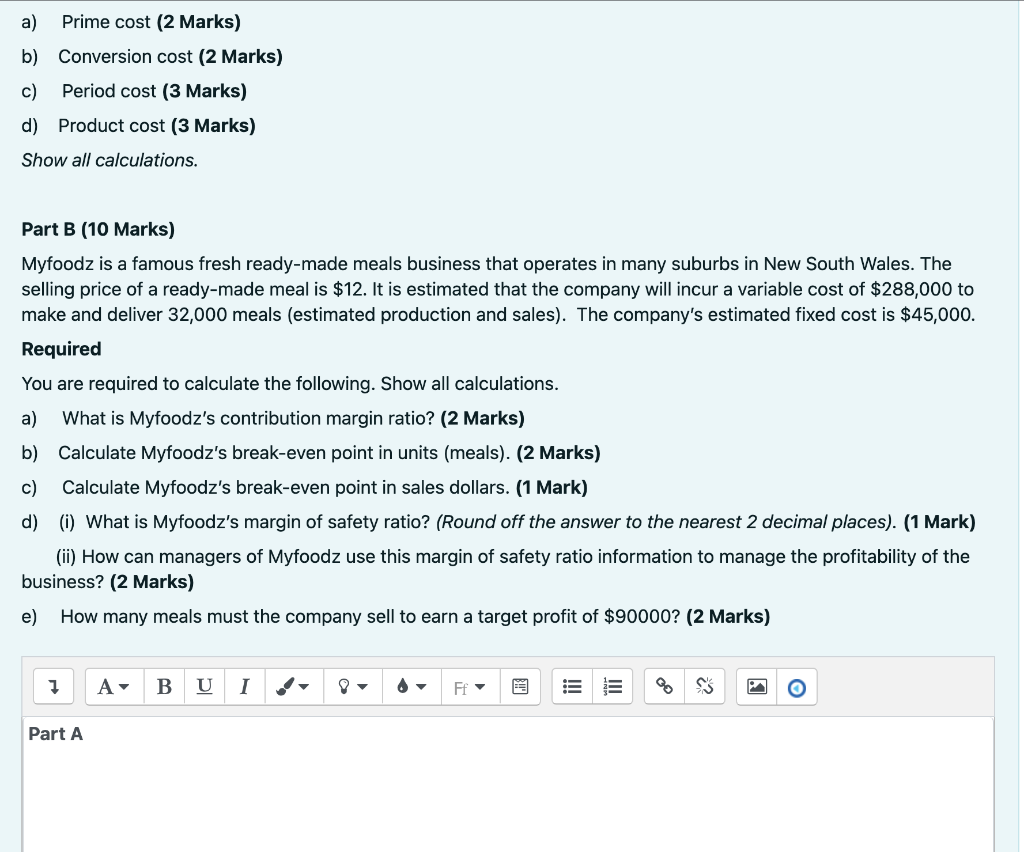

Question 8 (20 Marks) Part A (10 Marks) The costs incurred by Treats Bakery Ltd. as part of its operations are listed below. Cost Items Amount $ 4,700 Insurance on factory equipment Wheat Flour and other key baking materials Depreciation of computers used in the sales department 55,800 1,500 Bakers' wages 38,600 1,300 Utility cost of the sales department Rental for factory space 7,800 4,800 Depreciation on ovens and other factory equipment Rental of space for the sales department Salary of factory supervisor Factory utility cost 5,600 17,000 6,900 Required You are required to calculate the: a) Prime cost (2 Marks) b) Conversion cost (2 Marks) c) Period cost (3 Marks) d) Product cost (3 Marks) Show all calculations. a) Prime cost (2 Marks) b) Conversion cost (2 Marks) c) Period cost (3 Marks) d) Product cost (3 Marks) Show all calculations. Part B (10 Marks) Myfoodz is a famous fresh ready-made meals business that operates in many suburbs in New South Wales. The selling price of a ready-made meal is $12. It is estimated that the company will incur a variable cost of $288,000 to make and deliver 32,000 meals (estimated production and sales). The company's estimated fixed cost is $45,000. Required You are required to calculate the following. Show all calculations. a) What is Myfoodz's contribution margin ratio? (2 Marks) b) Calculate Myfoodz's break-even point in units (meals). (2 Marks) c) Calculate Myfoodz's break-even point in sales dollars. (1 Mark) d) (i) What is Myfoodz's margin of safety ratio? (Round off the answer to the nearest 2 decimal places). (1 Mark) (ii) How can managers of Myfoodz use this margin of safety ratio information to manage the profitability of the business? (2 Marks) e) How many meals must the company sell to earn a target profit of $90000? (2 Marks) 7 A B U I . Ff $S O Part A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts