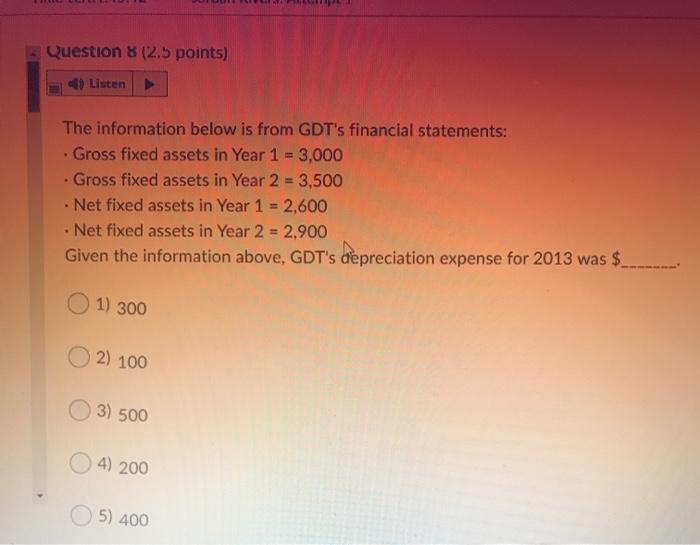

Question: Question 8 (2.5 points) 4Listen The information below is from GDT's financial statements: Gross fixed assets in Year 1 = 3,000 . Gross fixed assets

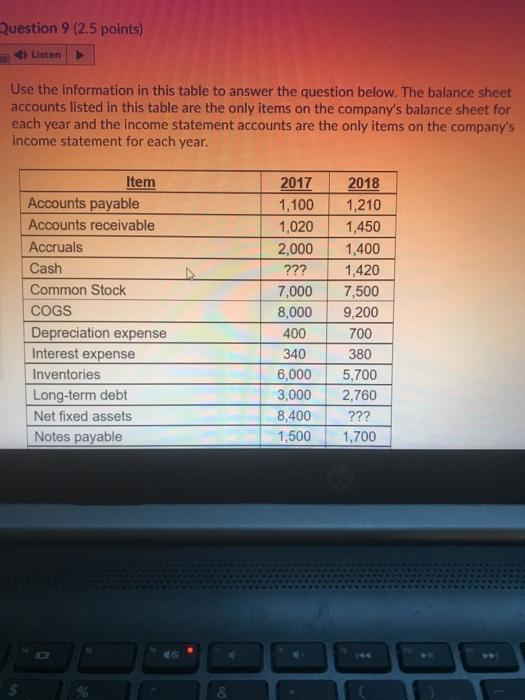

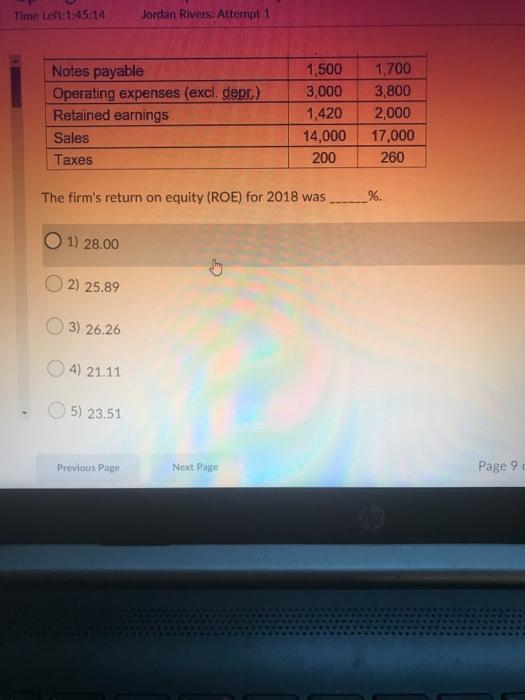

Question 8 (2.5 points) 4Listen The information below is from GDT's financial statements: Gross fixed assets in Year 1 = 3,000 . Gross fixed assets in Year 2 = 3,500 Net fixed assets in Year 1 = 2,600 Net fixed assets in Year 2 = 2,900 Given the information above, GDT's depreciation expense for 2013 was $ 1) 300 2) 100 3) 500 4) 200 5) 400 Question 9 (2.5 points) 4) Listen Use the information in this table to answer the question below. The balance sheet accounts listed in this table are the only items on the company's balance sheet for each year and the income statement accounts are the only items on the company's income statement for each year. Item Accounts payable Accounts receivable Accruals Cash Common Stock COGS Depreciation expense Interest expense Inventories Long-term debt Net fixed assets Notes payable 2017 1,100 1,020 2,000 ??? 7,000 8,000 400 340 6,000 3,000 8,400 1,500 2018 1,210 1,450 1,400 1,420 7,500 9,200 700 380 5,700 2,760 ??? 1,700 & Time Left:1:45:14 Jordan Rivers. Attempt 1 Notes payable Operating expenses (excl. derc) Retained earnings Sales Taxes 1,500 3,000 1,420 14,000 200 1,700 3,800 2,000 17,000 260 The firm's return on equity (ROE) for 2018 was %. 1) 28.00 They 2) 25.89 3) 26.26 4) 21.11 5) 23.51 Previous Page Next Page Page 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts