Question: Question 8 3 points COD Corporation is considering replacing an existing asset with a new one. The existing asset was purchased four years ago, had

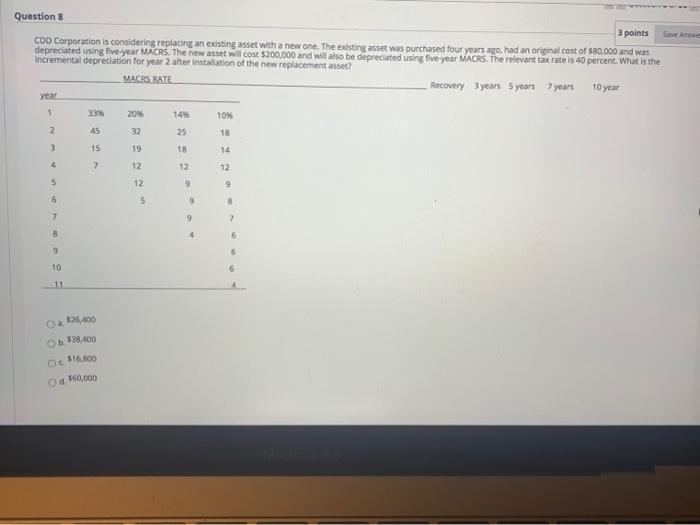

Question 8 3 points COD Corporation is considering replacing an existing asset with a new one. The existing asset was purchased four years ago, had an original cost of $80,000 and was depreciated using five year MACRS. The new asset will cost $200,000 and will also be depreciated using five year MACRS. The relevant tax rate is 40 percent. What is the incremental depreciation for year 2 after installation of the new replacement asset? MACRS RATE Recovery 3 years 5 years 7years 10 year year 1 33% 20 10% 2 32 25 18 3 15 19 18 14 4 7 12 12 12 5 12 9 9 6 3 9 7 9 7 6 9 6 10 6 $26.400 O Ob 538.400 $16.800 Od 160,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts